Sudden Impact: Accelerate FNOL and Transform the Claims Experience with Guidewire & TrueMotion

Sudden Impact: Accelerate FNOL and Transform the Claims Experience with Guidewire & TrueMotion

Insurance customers who are satisfied with the claims experience are 80% more likely to renew their policies, contributing to 30% higher profitability*

Smartphone-based telematics help insurers dramatically accelerate the claims process and deliver the kind of seamless customer experience policyholders expect—at the exact moment it matters most. By contacting auto insurance customers the moment a crash is detected, telematics-based services can help determine if emergency services are needed, and enable the customer to initiate the claims process on the spot. This kind of empathy and helpfulness at a stressful moment is no small matter, either. Studies show that expediting first notice of loss (FNOL) can help cut the cost of the average auto claim by $500 to $800 while optimizing the entire claims process. In turn, this can boost customer retention and lifetime value. According to JD Power, customers who are happy with the claims process are 80% more likely to renew their policies—contributing to as much as 30% higher profitability. When integrated to Guidewire, solutions partners like TrueMotion help insurers accurately price telematics-based lines of business, accelerate claims processes, and take the customer experience to a whole new level.

Who?

TrueMotion provides one of the world's leading smartphone-based telematics platforms. Founded in 2012, this Boston, MA-based company leverages machine learning to transform smartphone sensor data into valuable driving and crash insights. Insurers, rideshare companies, and fleets use TrueMotion data to fuel their pricing, claims, and retention programs, which help increase customer satisfaction and profitability.

What is the value proposition?

Using smartphone-based telematics, TrueMotion can assist insurance customers in the event of an accident and instantly provide a wide-spectrum of relevant information that gives the insurer an accurate view of what happened.

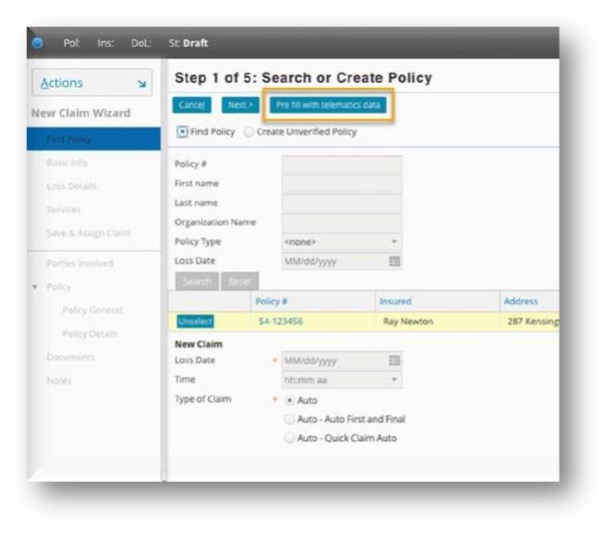

The moment a crash is detected, TrueMotion checks to see if emergency or roadside services are needed, and automatically directs first responders to the scene if the driver is unable to respond. With the TrueMotion accelerator for Guidewire, policyholders are also able to open a claim with a single key tap. All relevant telematics data is automatically piped into ClaimCenter, instantly prefilling FNOL flow forms with critical crash and contextual information—including date, time, location, weather and road conditions, speed of impact, airbag deployment, and more. All required fields are pre-populated, with zero data entry from the claim processor.

This instant access to crash data helps claim processors and adjusters validate facts of loss immediately, so they don't waste time asking questions that many drivers will have a hard time remembering. Instead, they can simply verify accident details, dramatically accelerating coverage reviews.

TrueMotion can even virtually transport adjusters direct to the scene of the incident. The crash location is pinpointed on Google Maps, and adjusters can get a 360-degree view of the collision site using Street View, without leaving ClaimCenter.

With TrueMotion, Guidewire customers know if the policyholder potentially visited a hospital after a crash. This helps adjusters evaluate if a policyholder may have suffered an injury that needs to be reported during the FNOL process.

What is the opportunity?

In-car and smartphone-based telematics are central to new and existing forms of usage-based insurance (UBI) policies, which are expected to see 2X growth this year, accounting for 7% to 8% of all policies. But telematics' most immediate benefit to insurers and policyholders is in the FNOL process.

According to industry studies, the average time between date of loss and reporting the loss is 0.6 days for telematics-enabled claims 6.7 days for all others. In addition to expediting FNOL, the real time data that telematics capture and report to insurers have been shown to help:

Accelerate time to resolution

Increase employee productivity

Reduce loss adjustment expenses

Boost customer satisfaction

Early adopters can leverage telematics services as a differentiator, especially when opting for smartphone-based solutions with virtually zero barrier to entry. By 2025, half of all non-injury related claims are expected to include automated processes initiated by in-car or smartphone-based telematics.

Want more detail?

Watch this video to see how TrueMotion telematics integration for ClaimCenter is a claims solution that helps accelerate FNOL and ensure positive outcomes for insurers and policyholders alike.

TrueMotion Telematics Integration for ClaimCenter 9.0.9

*https://www.propertycasualty360.com/2020/10/08/fnol-staying-ahead-of-customer-expectations/

Más Popular