Driving Insurance Innovation: Cogito

Driving Insurance Innovation: Cogito

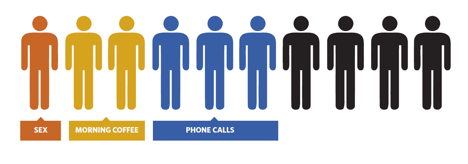

Things Consumers Would Give Up To Use Messaging

The survey results shown above, conducted by Twilio, highlight the importance of messaging to consumers. The survey was run across various age groups and industries. Combined with bots, messaging such as text and e-mail are an important vehicle for delivering anytime, anywhere service to consumers. I know I would give up any of the above to not have to talk to a person about a low-complexity question or transaction, but what about the questions and services that require human empathy and intelligence? Cogito is addressing that head-on with their technology to improve the service of more complex personal interactions.

Who?

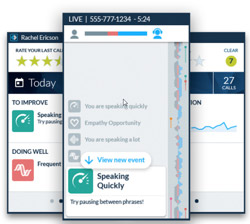

Cogito Dialog provides call center workers with real-time feedback on call performance to gently nudge better conversation habits.

Their Value Proposition

Cogito tracks metrics such as dialog speed, pauses, interruptions, volume changes, tone, etc. to provide real-time recommendations. Intuitive alerts create instant awareness of speaking behaviors and customer perception. Agents and customer service representatives are guided to speak with more empathy, confidence, professionalism and efficiency, while early signs of customer frustration and intent-to-purchase are taught to help improve service and close deals.

Cogito also provides real-time dashboards enabling supervisors to monitor and proactively intervene in live calls. Supervisors are automatically alerted to calls in which a customer is having a poor experience.

The Opportunity

Chatbots, artificial intelligence, and automation allow carriers to redirect humans from high-volume, low-complexity transactions to transactions that require human intelligence and empathy. In these high-value personal interactions, carriers can leverage applications like Cogito to ensure every personal interaction is delivered to the highest quality standard. In our intensely competitive Property and Casualty market, Cogito also advertises that their technology can improve productivity by the following:

Close rates by 15%

Increase revenue per customer by 10%

Accelerate time to close by 30%

Cogito CEO Joshua Feast will be a participant on our Connections panel, “InsurTech Innovation - What’s New for the Digital Insurer” on Wednesday, November 15, 2017 at 3:45 p.m. in Margaux meeting room #2.

Tags

Najpopularniejsze