The P&C insurance industry is undergoing a structural transformation. Rising loss ratios, driven by increasingly complex risk environments, operational inefficiencies, and persistent inflationary pressures, are prompting insurers to rethink their growth strategies. Insurers still rely on data-driven underwriting and strong operations to stay competitive, but many are also turning to mergers and acquisitions as a way to grow their reach and diversify their portfolios.

Recent M&A activity across North America reflects a strategic shift. Insurers aren’t just acquiring assets for scale anymore. They’re also looking for capability, whether that’s deeper underwriting expertise in a specific class or the technology that supports it. Technology and data assets, particularly in AI, analytics, and cloud-native platforms like Guidewire, can now play a large role in how these deals take shape.

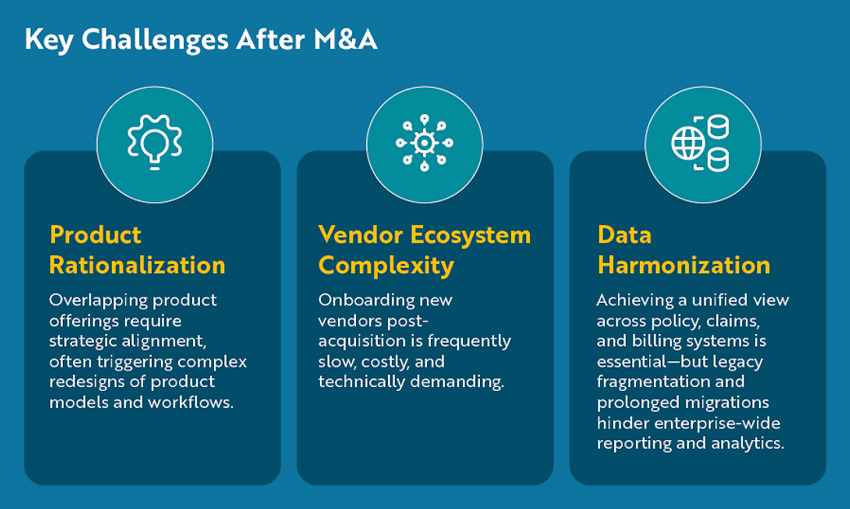

Yet, the promise of M&A often runs up against the realities of integration. Disparate systems, siloed data, and fragmented processes can chip away at the value of a deal and slow down the benefits teams expect to see.

When Auto Club Enterprises (ACE) acquired a U.S. subsidiary of the Canadian company Wawanesa Mutual, the team faced many challenges of integration.

While M&A unlocks growth potential, integration is still a major execution risk. Here’s a look at three key challenges that can often linger in an M&A initiative:

To navigate the challenges of product realization, vendor complexity, and pulling data together from multiple sources, insurers are turning to platforms designed to work smoothly across their business. Guidewire Cloud Platform stands out in this context, not only as a technology solution, but as a strategic way to support post-merger transformation.

“The capabilities of Guidewire have been critical to launching new products and migrating existing business to cloud,” says Mike Costello, Enterprise Service Delivery Group Manager, ACE. “In partnership with Cognizant, leveraging Advanced Product Designer (APD) enabled the rapid conversion of earthquake coverage from what was a policy endorsement to a standalone California Earthquake Authority (CEA) product. The Guidewire Policy Migration Tool (PMT) has allowed us to move data accurately and efficiently as we convert policies from legacy platforms market-by-market to Guidewire Cloud at renewal.”

Guidewire Cloud Platform: Enabling Streamlined Post-M&A Integration for ACE

With its modular architecture, scalable infrastructure, and cloud-native capabilities, Guidewire empowers insurers to align operations, streamline their technology, and unlock enterprise-wide value. Here are three capabilities that are delivering strong results for ACE during its post-M&A integration:

1. Accelerated Product Rationalization with APD

One of the most complex challenges in post-merger integration is rationalizing product portfolios. Acquired entities often bring overlapping offerings that need to be aligned to avoid redundancy and inefficiency. This process can be time-intensive, usually involving deep updates to product models and the workflows that support them.

One big challenge at ACE was how to bring earthquake coverage into a single approach. The acquired entity offered it as an add-on, while ACE offered a standalone California Earthquake product. By using APD and Cognizant’s CEA Product Model from Guidewire Marketplace, the team had a clear way to visualize, design, and carry out product updates at speed. MindMap visualization and the APD-enabled ability to design, deploy, and test directly within Guidewire PolicyCenter helped get stakeholders aligned early and kept the rationalization work moving. ACE launched a companion policy and retired the legacy model, giving them both operational clarity and a smooth experience for customers.

2. Simplified Vendor Ecosystem Integration with Marketplace Extensions

Vendor onboarding can be time and resource intensive during post-merger integration. Integrating new vendors into existing systems is often slow, costly, and technically complex.

When ACE set out to deliver a modern payment experience, it onboarded One Inc, a new vendor to their ecosystem. Traditionally, this would have required a lengthy, labor-intensive integration effort. Instead, the insurer turned to Guidewire Marketplace and used One Inc PremiumPay Extension for PolicyCenter, developed by Guidewire and powered by Integration Gateway, to fast-track deployment. The result was a rapid go-live and future-proof solution that stays aligned with One Inc’s latest updates.

3. Unified Data for Enterprise Insight: Overcoming Fragmentation

Data fragmentation is a common challenge in post-merger environments. Without a unified view, insurers end up with costly bridging solutions and delayed, piecemeal access to enterprise-level insights. In the past, getting to that unified picture required heavy data extraction and interpretation work that could span across multiple quarters or even years.

ACE needed a unified data repository and a reliable way to report across the enterprise. With Guidewire Cloud Data Access (CDA), the insurer published granular, real-time change data directly into its on-premises data warehouse, which helped streamline integration and speed up time-to-insight. The team also used Guidewire Migration Tools (PMT, Content Migration Tool, Business Migration Tool, and its data integration capabilities like CDA) to move and connect data efficiently, supporting real-time access and analytics.

These three cloud-native capabilities used by ACE are among the many capabilities empowering insurers to be nimble and adjust to business strategies like M&A. To learn more about ACE’s journey, in collaboration with Cognizant and Guidewire, register now for the January 29, 2026 webinar “Driving M&A Success with Guidewire Cloud: Auto Club Enterprises, Cognizant, Guidewire.”