If you work in Australian general insurance, the General Insurance Code of Practice (GICoP) isn’t just another acronym. It's how you show customers you’re committed to doing the right thing—quickly, clearly, and fairly.

But let’s be honest: living up to those commitments operationally has often felt like an uphill battle.

The Code sets strict, time-bound expectations for updates and decisions, in addition to supporting customers experiencing vulnerability and financial hardship. Historically, many insurers have managed these obligations through a patchwork of bespoke rules, manual follow-ups, and the occasional frantic sticky note. It’s a process that increases costs and keeps compliance managers awake at night worrying about breach risks.

With the Olos release, Guidewire has turned those commitments into an operational capability you can adopt quickly and scale confidently. We’ve baked the essentials into the platform so your teams can stop worrying about compliance and start focusing on the customer.

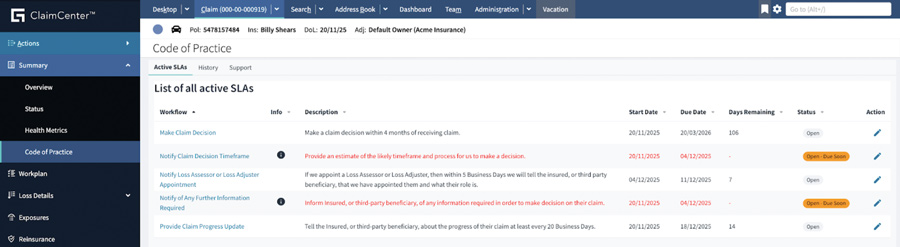

We’ve automated the heavy lifting. Real claim moments now trigger and end obligation timers automatically. Reminders land with the right people at the precise moment they are needed, and a clear dashboard helps claim handlers stay ahead without the need for side-spreadsheets.

Fig.1 - Code of Practice Dashboard embedded in Guidewire ClaimCenter

When someone is identified as experiencing a vulnerability, Guidewire InsuranceSuite records the indicator and support offered—and carries that context across interactions—so customers don’t have to re‑tell their story.

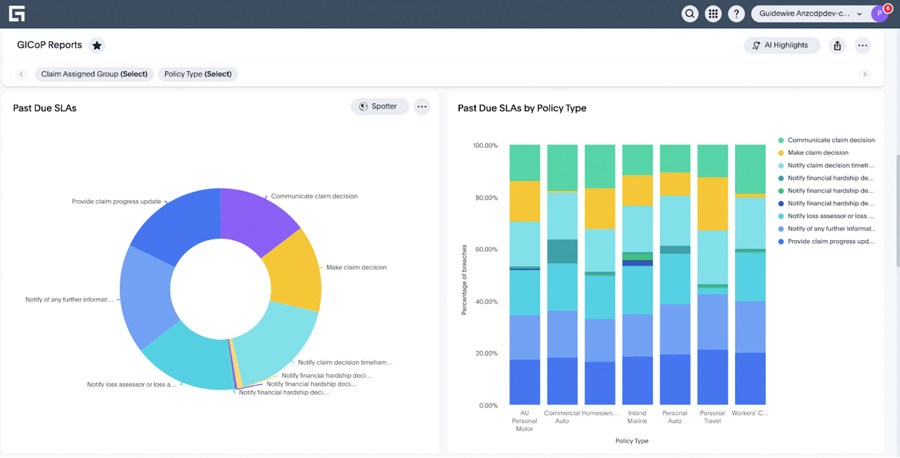

From a leadership perspective, you get immediate oversight through curated datasets and Guidewire Explore liveboards. This includes vital views that help identify and support people experiencing vulnerability or financial hardship—a critical focus for the Australian market.

Under the Hood: How Olos Tackles GICoP

We have moved the Code from policy to practice using a few key components:

- AppEvents: ClaimCenter emits real claim events that automatically start or end obligation timers.

- Workflow Services: Runs reusable, parameterised workflows for due dates, reminders, and escalations.

- Jutro Dashboards: Provides simple, human-in-the-loop visibility embedded into ClaimCenter.

- Explore: Surface past-due trends and root causes to drive continuous improvement.

Fig.2 - Prebuilt Explore Reports

Ready to Roll Out

Included in the Olos release is a library of pre-built obligation workflows aligned specifically to GICoP, Guidewire Data Studio datasets, and a repeatable enablement path documented specifically for Australian insurers. It is productised, configurable, and ready for rollout.

This is about complying with confidence. To learn more, contact your Guidewire representative or reach out to your account team. We’d love to line up a short demo and show you how it works. And check out this Insurance News webinar about compliance featuring executives from Guidewire and Hollard.