Renewable Energy - A Success Story

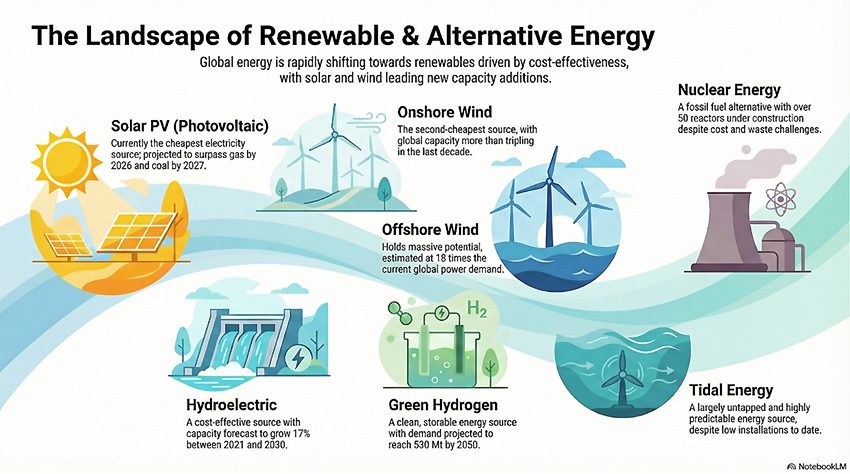

The clean energy revolution is accelerating, with the International Energy Agency (IEA) predicting a massive expansion in global renewable electricity production. This output is projected to exceed 17,000 terawatt-hours (TWh) by the end of the current decade. This staggering figure represents nearly a 90% rise from 2023 levels and would be enough energy to satisfy the estimated combined power needs of China and the United States in 2030.1

This trajectory is largely powered by the growth of solar (PV) and wind installations, driven by continually falling PV module costs. The shift is gaining speed because solar and wind power are frequently identified as the most economical forms of electricity globally. In 2024, renewable sources represented a dominant 92.5% of all fresh electricity capacity added.2

Solar power expansion continued to exceed expectations, with a record 65 GW of new capacity installed in 2024. In mid-2025, for the first time, solar became the single largest source of electricity in the EU.3

According to the IEA, this growth trajectory is set to achieve several global key milestones over the coming years:

- 2025: Renewables are expected to surpass coal-fired generation.

- 2026: Both wind and solar power generation are individually poised to exceed power generation from nuclear energy.

- 2029: Solar PV electricity generation is on track to become the world’s largest renewable power source, overtaking hydropower.4

Europe is a key driver of this acceleration, with projected increases in its renewable energy capacity by 67% between 2025 and 2030. Nations like Germany and Spain are leading, already producing over 40% of their electricity from wind and solar, with Spain targeting an ambitious 81% renewable power by 2030.5

Backbones of the Green Energy Transition

Optimising and reducing overall energy consumption is key on our journey to a more sustainable energy system. Energy efficiency is capable of cutting global energy consumption by 31%, which translates to over $2 trillion in annual energy cost savings, as per research by the World Economic Forum and PwC, all without compromising economic output. Smart grids, AI analytics, and demand response programs are actively employed to optimise energy consumption. Alongside behavioural incentives, they contribute to a more resilient, low-carbon energy system.

Furthermore, energy storage is a critical component for maintaining grid stability and balancing supply and demand as intermittent renewable sources are increasingly brought online.6

Insurance of renewables

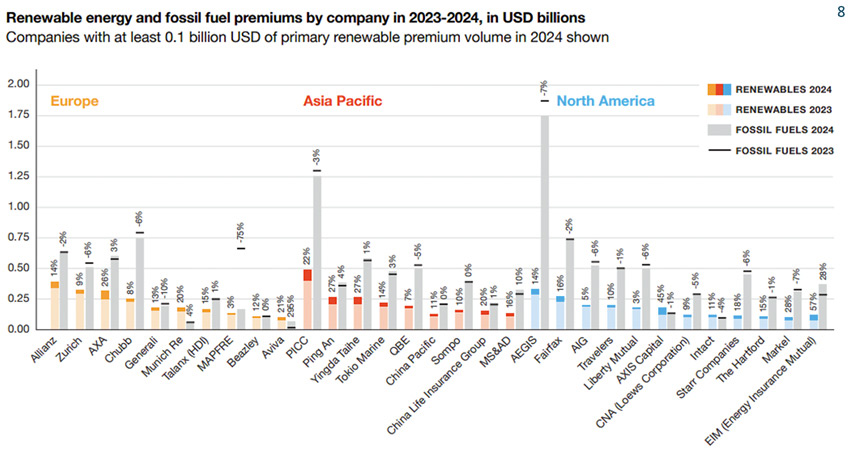

Since 2020, the global renewable energy insurance market has experienced consistent growth, with its gross direct written premium (GDPW) climbing 9% annually, from $5.65 billion to a real-terms value of $8 billion by 2024. In sharp contrast, the fossil fuel insurance sector saw a contraction of approximately 2% each year during the same period. This divergence underscores the ongoing energy transition.

Nevertheless, the fossil fuel market size is still over three times larger than that of renewables, and the annual growth rate for renewable premiums is currently only half of the 18% target the IEA suggests may be required for the 2030 net-zero pathway.7

The market for insuring renewable energy projects remains significantly constrained for affordable, worldwide insurance capacity which threatens critical investments needed for both the energy transition and energy security. Reports indicate that AXIS Capital, Aviva, and Munich Re are the sole major insurance carriers whose direct premiums for renewable energy surpass those for fossil fuels.9

However, Gallagher estimates that the renewable energy sector will be a substantial source of new insurance business. Insurance for renewables is included in various lines of business - engineering, casualty, marine, and energy.10 The most common interests insured are property values (such as machinery, turbines, platforms, installations, warehouses, and buildings), the business value generated from the property (revenue, rent, profit), liability values (third-party) and specific interests (construction phase).

Insurers are key in the energy transition

According to Urgewald, a German NGO, the three largest European underwriters of renewable energy - Allianz, AXA, and Zurich - jointly recorded $141 million in new renewable premiums between 2023 and 2024, with AXA securing the biggest portion at $65 million. For total renewable premiums in 2024, Allianz led the European firms with $390 million, followed by Zurich at $320 million and AXA at $315 million.11

In many cases, insurers writing business in renewable energy projects have not only offered underwriting to their longstanding clients, but also advised with risk and engineering expertise. AXA XL started with offshore wind farm insurance in 2009 and has since been supporting a wide range of pioneering clean energy projects and technologies, including offshore wind construction in the North Sea, large scale solar installations, bioenergy plants, battery storage systems, carbon capture, and next generation power plants that will run on green hydrogen.12

Geothermal projects, especially deep drilling, come with significant risks. HDI Global, for example, provides insurance coverage for a geothermal heat energy project of MTU Aero Engines in Munich. With HDI Global’s insurance expertise, the project is well-protected against the risks of deep drilling, paving the way for a greener future in industrial energy use. The basis of the insurance is construction coverage, with the difference being that the focus of protection is not on buildings, but on the unknown interior of the Earth. With property assets in the millions, potential claims could endanger the entire project. An insurance solution that enables HDI Global clients to advance their sustainable transformation is highly relevant to all types of industries.13

Challenges to insure renewables

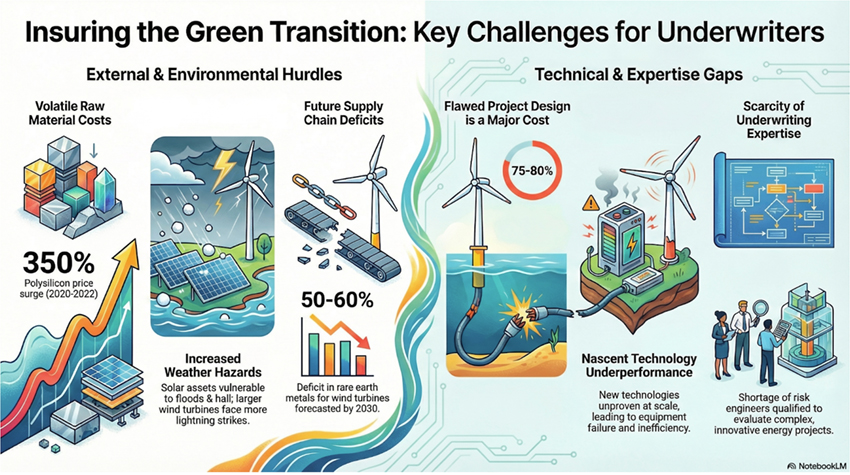

While the renewable energy insurance portion is growing, it is also coming with significant challenges. These are similar across the globe with regional variations.

A critical challenge is the insufficient availability of location-specific data and comprehensive information necessary to accurately underwrite projects utilising cutting-edge, nascent technologies. Operational and financial risks are compounded by the volatile nature of the supply chain, including steep cost increases for materials like polysilicon and projected 2030 deficits for rare earth metals vital for wind turbine generators. Furthermore, adverse weather conditions frequently delay construction, while errors stemming from flawed project design, such as issues with under-sea cables, are responsible for the most significant insurance losses. Insurers must also contend with the scarcity of qualified risk engineers, necessitating a focused effort to recruit expertise in rapidly changing fields like new energy technology.14 15 16 17 18 19 20

How technology supports insurance for renewables

Technology is a crucial enabler for enhancing risk assessment in the renewables sector, offering several key applications. Remote-sensing and satellite imagery, for instance, help identify and monitor risks from natural hazards like fires, floods, and land subsidence.hey track vegetation growth around energy infrastructure, which is especially important for solar farms and transmission lines.

Furthermore, Digital Twins, which are virtual replicas of renewable energy assets, allow for continuous performance and condition monitoring, thereby supporting predictive maintenance and minimising the risk of unscheduled outages and equipment failures.21

When insuring wind turbines, insurers often face the challenge of no or little historical data, which leads to incomplete coverage plans and high deductibles. This is an unsatisfactory situation for both insurer and customer. Prothinx, a start-up supported by the larger HDI insurance business, offers a solution with an innovative risk management approach leveraging AI. They work with predictive maintenance systems that collect data directly from wind turbines facilities and their operating systems. They analyse them constantly in order to identify anomalies and deviations, thus compensating for the lack of historical data with real-time data and analytics. Prothinx acts as a bridge between technology and insurers and provides operational and financial security for all involved stakeholders.22

Apart from data issues, many commercial lines and renewables insurers are facing fragmented underwriting systems. At the same time, complexity can be high with specific requirements for reinsurance, coinsurance, layering, multi-currency and multi-national policies with fronting arrangements as well as negotiated commission, split bills, and multi-producer participation. And, underwriters spend almost half of their time on activities other than underwriting decision making.

A comprehensive cloud platform for commercial insurance like Guidewire handles all of the above named requirements and provides an innovative agentic AI interface to handle time-consuming tasks, enabling professionals to focus on nuanced decision-making, relationship-building, and ensuring accountability for AI-driven outcomes.

Underwriting AI agents service all stages of the underwriting process - from Submission Document Ingestion to Quote Readiness agents - giving back time to underwriters so they can focus on their core competencies to help drive the success of renewables for the next decades.

1 Source: https://www.iea.org/energy-system/renewables

2 Source: https://global.insure-our-future.com/wp-content/uploads/sites/2/2025/09/IOF_MonteCarloBriefing_090225_Digital.pdf

3 Source: https://climateobservatory.eu/sites/default/files/2025-09/Flagship-Report-2025-Summary-for-Policy-Makers.pdf

4 Source: https://www.iea.org/energy-system/renewables

5 Source: https://axaxl.com/fast-fast-forward/articles/how-specialist-insurers-are-helping-europe-accelerate-growth-in-renewables

6 Source: https://www.weforum.org/stories/2025/06/shifting-energy-markets-geopolitics

7 Source: https://global.insure-our-future.com/wp-content/uploads/sites/2/2025/09/IOF_MonteCarloBriefing_090225_Digital.pdf

8 Src pic: https://global.insure-our-future.com/wp-content/uploads/sites/2/2025/09/IOF_MonteCarloBriefing_090225_Digital.pdf

9 Source: https://www.weforum.org/stories/2025/03/how-insurers-can-help-protect-and-nurture-innovative-low-carbon-energy-projects/

10 Source: https://www.ajg.com/gallagherre/-/media/files/gallagher/gallagherre/news-and-insights/2024/november/gallagherre-insuring-the-transition-risks-and-opportunities-in-renewable-energy.pdf

11 Source: https://www.urgewald.org/en/medien/chinese-insurers-lead-in-renewables

12 Source: https://axaxl.com/fast-fast-forward/articles/how-axa-xl-is-helping-to-power-europe-s-energy-transition

13 Source: https://www.hdi.global/infocenter/insights/2024/tapping-into-the-heat-beneath-our-feet/

14 Source: https://www.weforum.org/stories/2025/03/how-insurers-can-help-protect-and-nurture-innovative-low-carbon-energy-projects/

15 Source: https://www.weforum.org/stories/2025/03/how-insurers-can-help-protect-and-nurture-innovative-low-carbon-energy-projects/

16 Source: https://www.munichre.com/content/dam/munichre/contentlounge/website-pieces/documents/Tech_Trend_Radar_2025.pdf/_jcr_content/renditions/original./Tech_Trend_Radar_2025.pdf

17 Source: https://www.whitecase.com/insight-alert/renewable-energy-new-challenges-require-bespoke-approach-risk-allocation

18 Source: https://www.whitecase.com/insight-alert/renewable-energy-new-challenges-require-bespoke-approach-risk-allocation

19 Source: https://www.weforum.org/stories/2025/03/how-insurers-can-help-protect-and-nurture-innovative-low-carbon-energy-projects

20 Source: https://www.ajg.com/gallagherre/-/media/files/gallagher/gallagherre/news-and-insights/2024/november/gallagherre-insuring-the-transition-risks-and-opportunities-in-renewable-energy.pdf

21 Source: https://www.weforum.org/stories/2025/03/how-insurers-can-help-protect-and-nurture-innovative-low-carbon-energy-projects/

22 Source: https://www.prothinx.io/smartassets