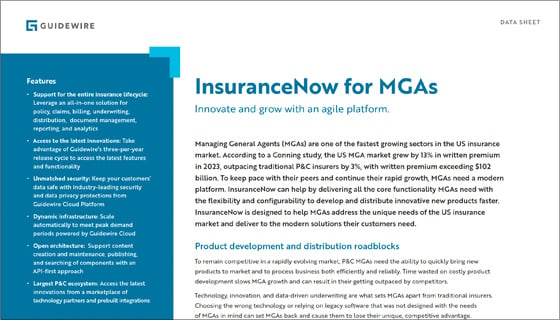

Guidewire InsuranceNow

An All-In-One Core Platform to Support the Insurance Lifecycle

InsuranceNow is a powerful core platform, purpose-built to meet existing customer needs and adapt to new capabilities driven by the requirements of the world’s largest insurers and MGAs.

Product Definition

Accelerate time to market with InsuranceNow GO pre-packaged implementations and low-code product configuration.

Market Distribution

Deliver modern digital experiences with an out-of-the-box sales portal and API connectivity to all your distribution partners.

Underwriting

Improve underwriting efficiency with embedded insurance analytics, business intelligence, and Excel Designed Rating.

Policy Management

Provide self-service access for your customers with an out-of-the-box service portal that enables straight-through processing of your insurance workflows.

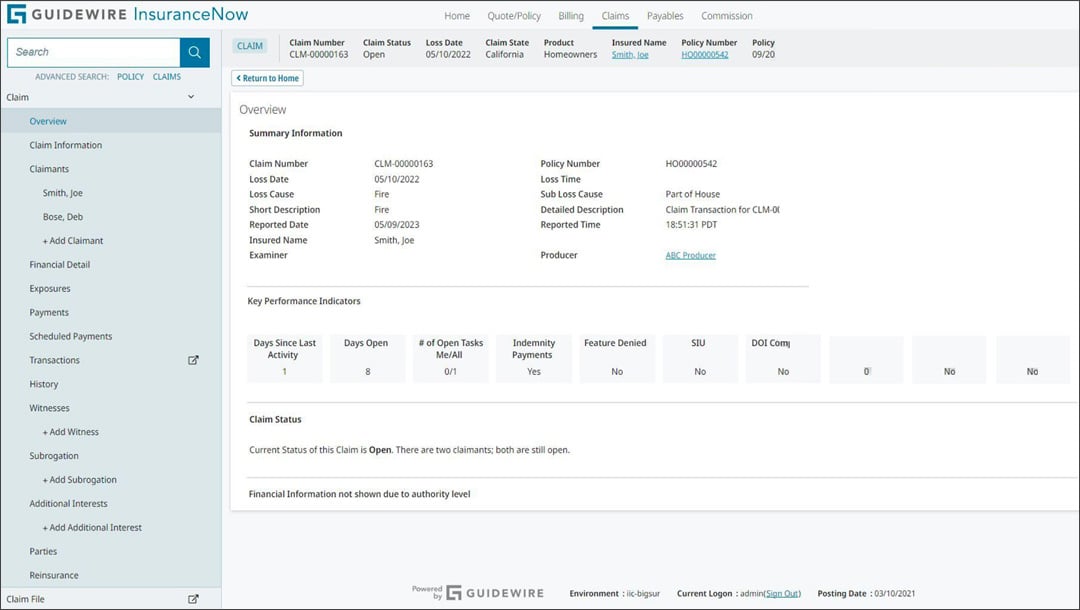

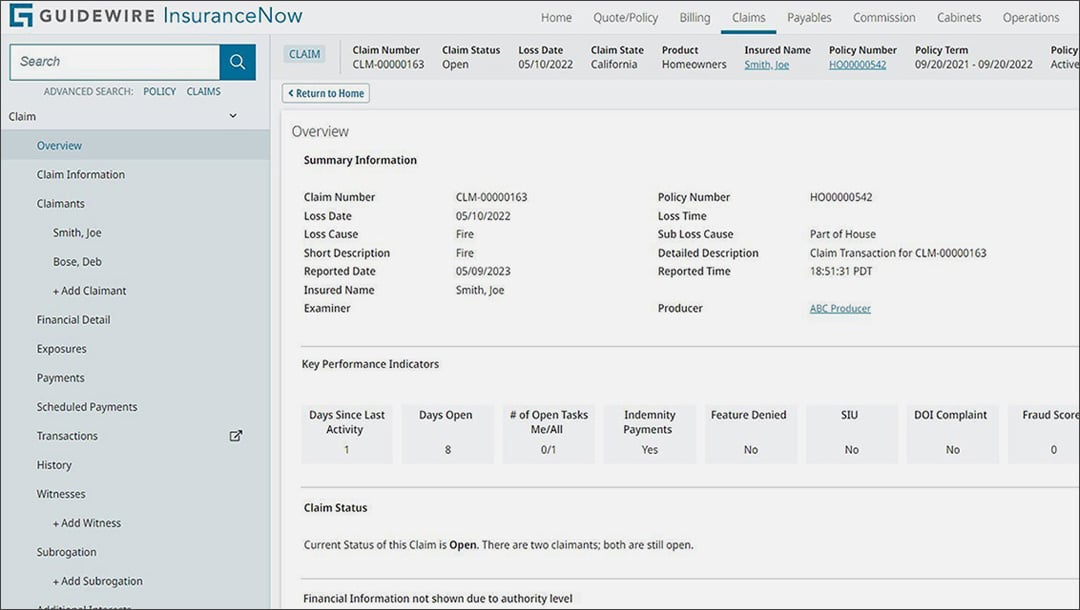

Claims Servicing

Close claims faster with streamlined claims management and delight customers with integrated two-way communications through Hi Marley.

What is InsuranceNow?

InsuranceNow is a cloud-based solution with everything you need to engage, innovate, and grow efficiently.

Built for Your Needs with Capabilities Influenced by the Needs of the World

Benefit from the unmatched R&D of the world’s largest P&C-focused core software company.

Guidewire Is a Connected Experience

Proven Experience. Earned Trust.

SEE WHAT OUR CUSTOMERS SAY:

57

$10 Bil+

145,000+