Launch End-to-End Embedded Insurance Faster Than Ever on Guidewire Cloud

Embedded Insurance presents an opportunity for carriers to serve new customers in a new distribution channel, offering insurance at the point-of-sale of a non-insurance product. Guidewire’s Solution for Embedded Insurance addresses this challenge head-on with a rapidly deployable, quote-to-claim offering that includes:

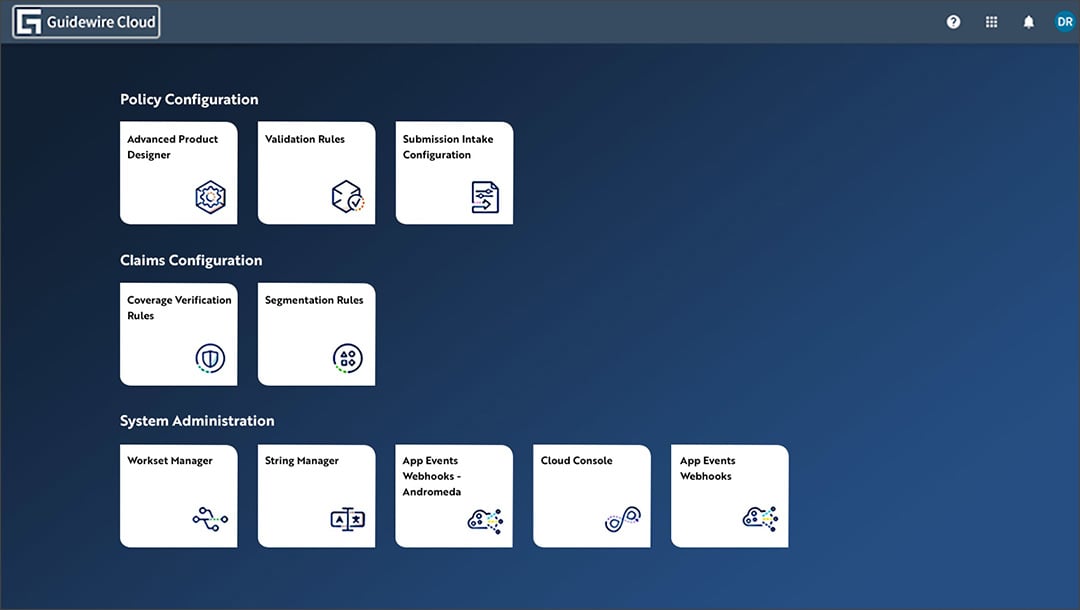

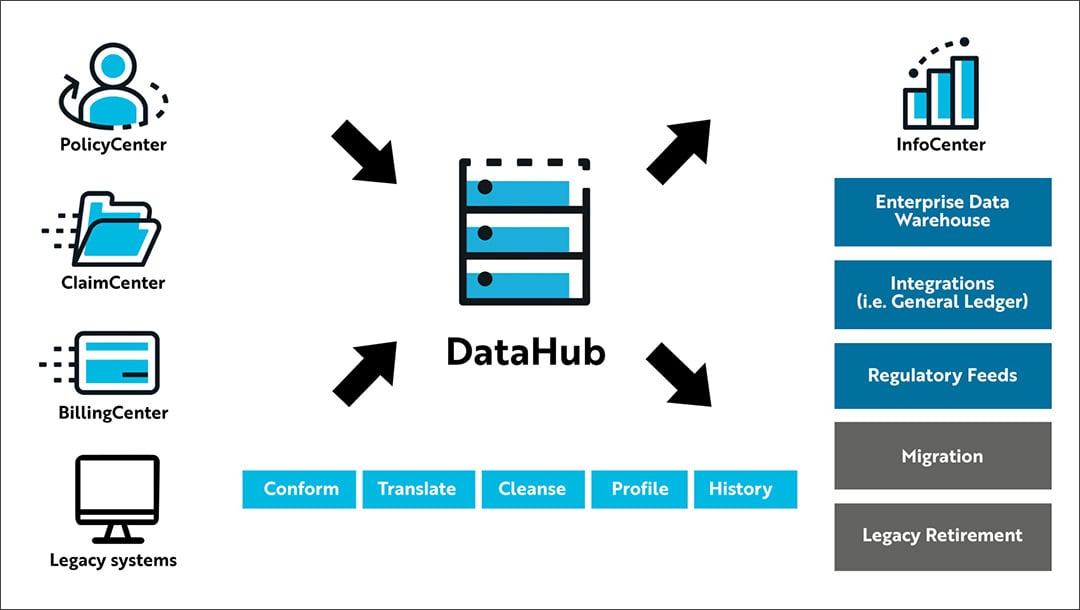

- Core systems

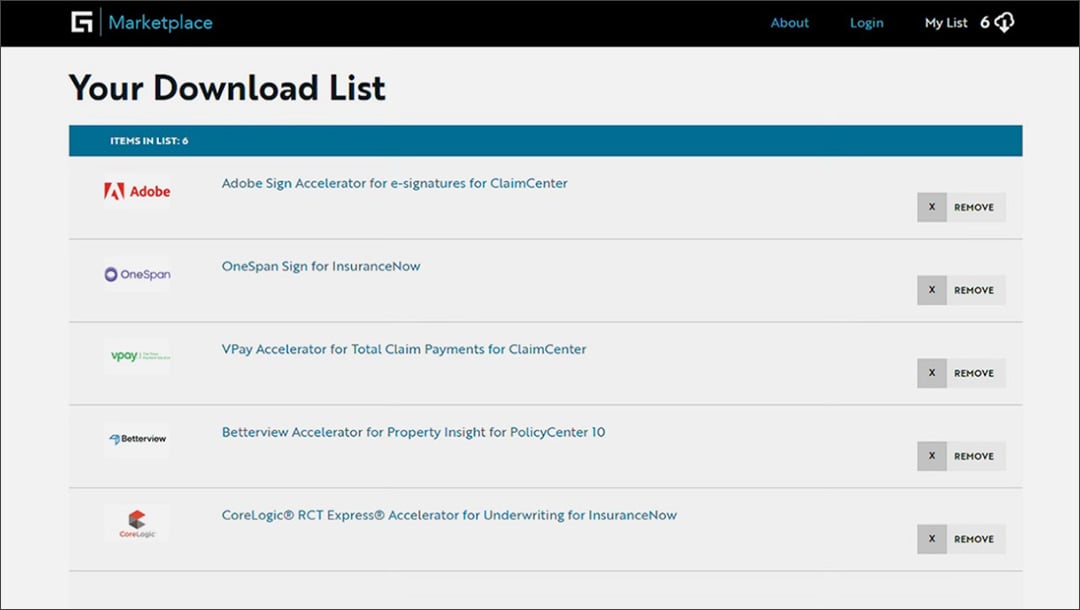

- Integrations

- Implementation best practices

- Predefined use cases

The solution is optimized for travel insurance but can be tailored to other lines of business as needed.