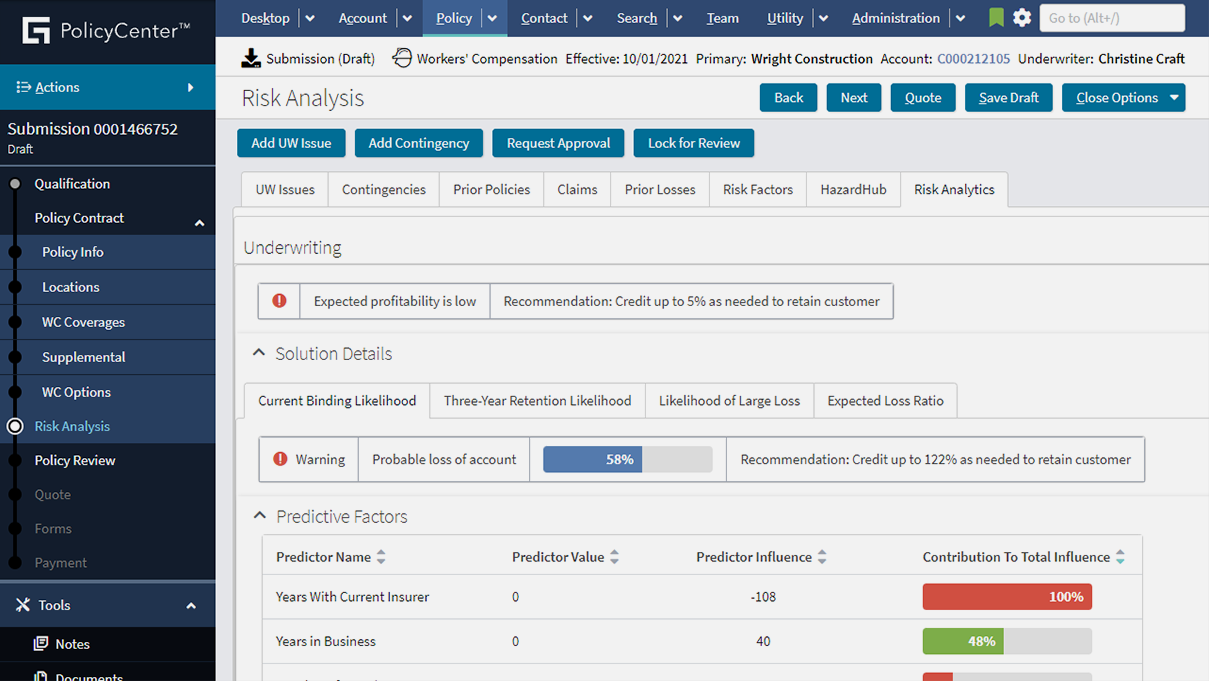

“With Guidewire Predict, and the ability to quickly and consistently assign each claim to the right handler from the start, we can settle claims faster – fostering even more trust and lasting relationships with our policyholders.”

Raymond Zientara

Assistant Vice President