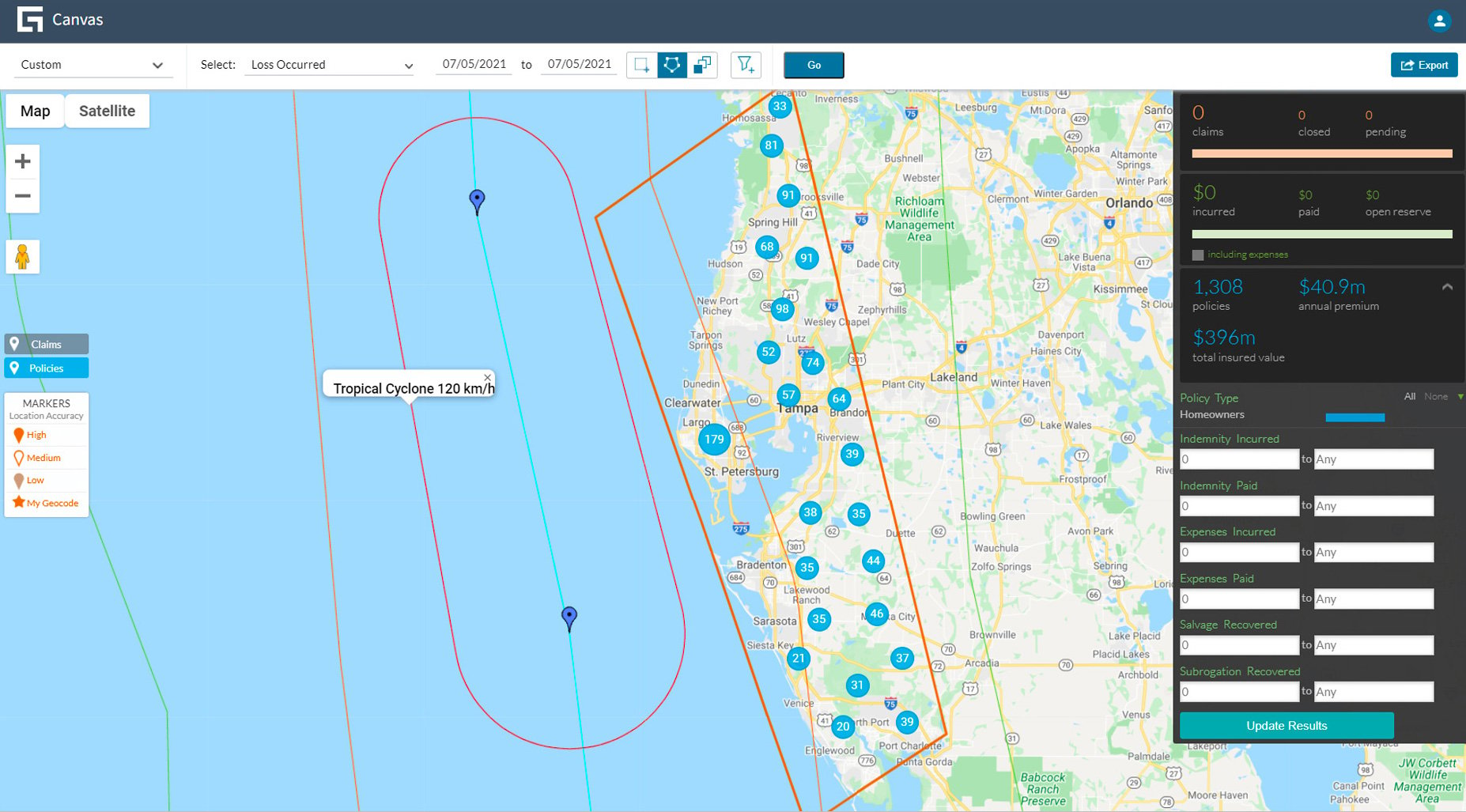

“With Canvas we are able to plot where our policies are in relation to the wildfire and proactively reach out to our policyholders to tell them what coverages are provided if they’re temporarily forced from their homes. People really appreciate that.”

James Kaufmann

Former SVP, Claims

.png?h=720&iar=0&w=1280)