Driving Insurance Innovation: Plug and Play 2018 Winter Symposium

Driving Insurance Innovation: Plug and Play 2018 Winter Symposium

Recently I had the pleasure of attending the Plug and Play 2018 Winter Symposium where InsurTechs “pitched” their value propositions in five minutes to a large audience of insurers and potential investors. In my final InsurTech blog for 2018, I highlight three interesting value propositions from the session.

The rozieai CEO presenting their pitch at Winter session.

(London)

Smart home hub. Their approach of leveraging an “automist” uses 10x less water than traditional sprinklers to protect a property from fire. All activity is stored on a “blackbox” to help investigate a claim. When the system is not active, they leverage a “dry pipe” approach so that they are less susceptible to leaks and freezing pipe bursts. Coming from Canada, I have personally experienced freezing pipe bursts and they cause significant water damage to the walls, floors, and furniture.

Plumis started off in the U.K. and is installed in 3,000 homes. They see a unique opportunity in the U.S. to leverage their automist approach, particularly in California with our severe water restrictions.

Plumis pitch slide highlighting automist coverage.

(New York)

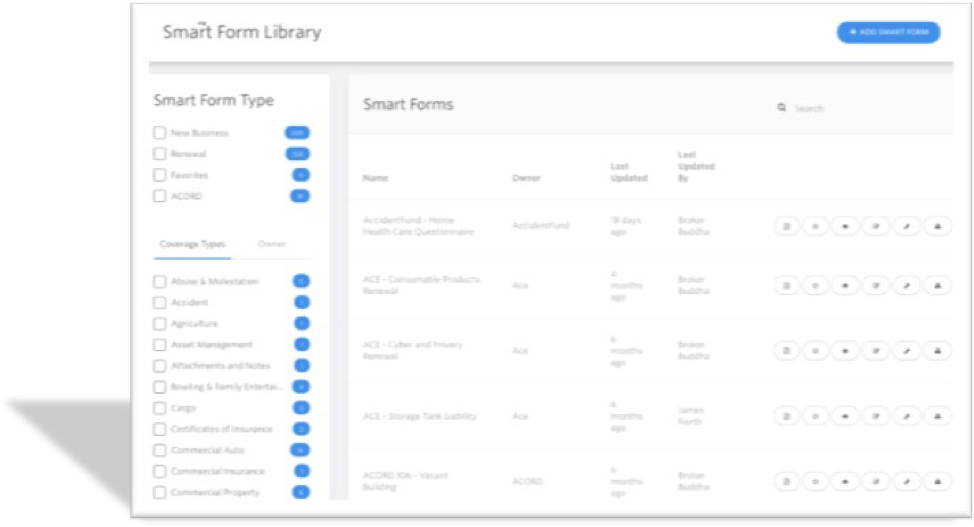

Interactive smart forms. A customer engagement platform for brokers and captive agents. The company empowers commercial insurance brokers to collect application information online through smart forms and then generates signed PDFs which can be sent to insurers for quotes. It provides an interactive Smart Form Library that supplies brokers with hundreds of ACORD forms and insurer supplementals available in an easy-to-complete online format. The company’s differentiator is its emphasis on design; it believes it sets them apart from competitive offerings.

Image of the Broker Buddha Forms Library

(Chicago)

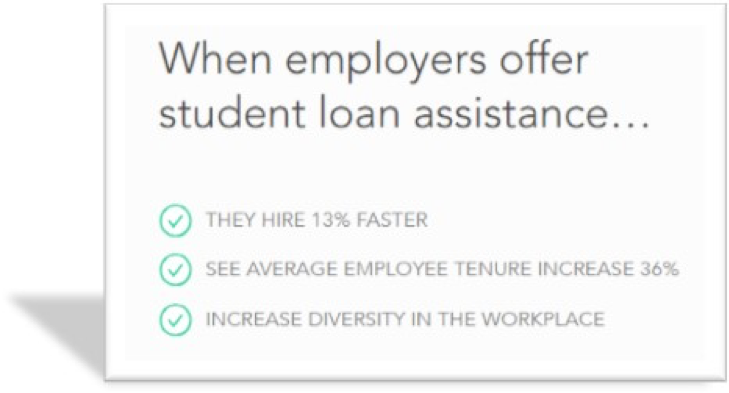

One of the main reasons that insurers ask to speak with me about innovation is to understand how they can use technology to attract and retain millennial talent. Consider that by 2025, 75% of the global labor force will be comprised of millennials who have considerable student debt. Peanut Butter administers student loan assistance programs so employers can attract and retain college-educated talent. The company is an independent benefit administration firm, built from the ground-up with human resources (HR) veterans to help employers more easily offer student loan assistance as a benefit without creating a burden for the insurer’s internal HR team.

Benefits from Peanut Butter website

Tags

Most Popular