From Success Factor to Tablestakes

Digitisation has been an ongoing challenge for the insurance industry for over a decade. Digital capabilities show their relevance in different facets - from channels, to data, to automation. Early movers set the stage for digital insurance business models 10 years ago - like Lemonade in the US - and almost all insurers globally have followed since then. However, grades of digitalisation still differ depending on lines of business and region. Complex commercial insurance, for example, is a highly customised business whereas motor lines and personal lines in general show a high degree of automation - for example Tryg Norway has achieved 80% digital claims filing and 50% straight-through-processing. Also, the German entity of Swiss insurance group Baloise has achieved significant enhancements in its broker communication by strengthening digital channels.

Tryg: Achieving Next Level Claims Automation

Insuring Climate Risk and Resilience

As the global protection gap continues to grow, climate and nature-related risks are challenging insurers like never before. Global losses from natural catastrophes have been growing over the last decades, exceeding US$300 billion in 2024. Insured losses surpassed the US$100 billion mark in 2025 for the sixth consecutive year.1

The growing physical risk landscape requires a robust insurance industry to keep up with accelerating risk and vulnerability factors. Insurers need to harness new developments offered through innovative technology – digital, data and analytics – to build and maintain greater resilience. Sensors and sensor data, for example, are important components of insurance solutions for climate resilience - e.g. parametric insurance for storm or flood risk is based on triggers of wind speed or water depth data that is measured by sensors. Companies like Roost based in the US or Bosch and Grohe in Germany support smart home solutions with sensors to detect water and humidity.

Also, underwriting property risk in high risk zones requires granular data sets enriched with satellite imagery and predictive analytics to identify risks that insurers can still take on. A recent study of Triple-I and Guidewire in California has shown that, with granular risk assessment, insurers can still find risks that fall within their appetite, even in wildfire prone areas.

Homeowners who don’t qualify for insurance coverage initially could receive automated recommendations on how they reduce their risk through resilience measures, like flood resistant roofs or fire-resistant vents. This would be instantly created by an agentic underwriting assistant, which is reviewed by the underwriter. Ideally, the homeowner would also receive a newly calculated insurance quote, sent to them to incentivise their investment for insurability.

Enabler of the green transition

Insurers are playing a leading role in the transition to a more sustainable and resilient economy and society. They are in a unique position to support sustainable business models with insurance coverage and promote sustainable or green products and services with premium discounts. Renewable energy projects wouldn’t be successful without insurers covering new risks relating to solar, wind, bio energy, green hydrogen and battery-storage-related technologies.

According to a recent report from BCG and the World Economic Forum, the green economy was the second fastest-growing industry in the decade since 2015, with the first being technology. Generating more than US$5 trillion annually, the green economy is expanding at double the rate of traditional sectors. With decreasing technology costs and rising demand, the justification for investing in climate and resilience initiatives has never been more compelling.2

Various sustainable business models of the sharing economy for example rely on digital channels, such as car or bike sharing that is set up via mobile phone. Also, new insurance products like green building insurance can include various parameters like LEED or BREEAM certifications that can easily be incorporated and automated via digital capabilities of an agile insurance core platform. LEED is US-based and the most widely recognised green building rating system globally and UK-based BREEAM is a holistic framework for assessing sustainability in the global built environment, but with a stronger European footprint.

Digital innovation as foundation

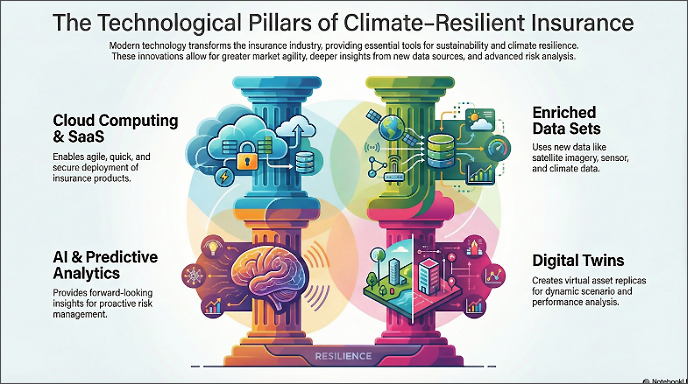

Progress in sustainability and climate resilience is to a high degree based on technology, data, and digital innovation. Without key elements like cloud computing, data, analytics, and digital capabilities in respect to various insurance operations - from products to underwriting and claims - insuring sustainable business models, carbon emissions tracking, proactive nat cat claims management, and granular risk assessment wouldn’t be possible.

Spotlight: Digital Twins in renewable energy projects

Technology is pivotal in advancing risk assessment within the renewables sector. Applications such as remote sensing and satellite imagery are essential for monitoring natural hazards like fires, floods, and land subsidence, as well as tracking vegetation growth near solar farms and transmission lines. Digital Twins facilitate continuous performance monitoring, enabling predictive maintenance that reduces the likelihood of equipment failures and unscheduled outages.

Digital Twins mark a significant shift from traditional risk modeling. Unlike static simulations, they create dynamic models that continuously ingest real-time data to adapt and learn from outcomes. By integrating machine learning, behavioural analytics, and extensive data, these systems simulate entire economic subsystems, rather than just individual transactions.

Digital Twins facilitate continuous risk assessment, which could replace annual underwriting cycles with real-time premium adjustments driven by policyholder behavior and external factors. Through dynamic virtual replicas of customers and financial entities, risk managers can go beyond static analysis to identify complex interdependencies, behavioural patterns, and emergent risks often missed by traditional models.3

Operationalizing innovation

New approaches, new technology, new data, new vendors – insurers are often overwhelmed by the sheer number of options and opportunities in digital and technological capabilities. And even if they find their preferred climate models, data sources, or innovation partners, these often stay in silos and lack a comprehensive integrated approach. Underwriters, claims handlers, and other insurance professionals need this innovation at their fingertips, ready to use and make a difference in their daily work, condensed in a risk score, a quote, or a claims payment with precise recommendations for customers, ready to be sent with a click. The next step for insurers will be to operationalize innovation and make it a great user experience for their teams, agents, vendors, and ultimately their customers.

- 1 Source: https://www.swissre.com/press-release/2025-marks-sixth-year-insured-natural-catastrophe-losses-exceed-USD-100-billion-finds-Swiss-Re-Institute/f710c271-58c8-4c48-9004-05203634d1e0

- 2 Source: https://www.weforum.org/publications/already-a-multi-trillion-dollar-market-ceo-guide-to-growth-in-the-green-economy/

- 3 Source: https://www.garp.org/risk-intelligence/culture-governance/say-hello-little-friend-251212