In case you missed it -

Part 1: Regulation as a key driver for sustainability - From duty to value

The Major Risk for Insurers

According to the World Economic Forum the top four long-term risks are climate and nature related as shown in their Global Risk Report 2025.1 It’s only common sense to assess the exposure of insurers to these global risks and how they are impacted financially.

The EU Solvency II Directive mandates robust risk management systems, acknowledging climate change as a significant risk. Within this framework, the Own Risk and Solvency Assessment (ORSA), requires insurers to map both transitional and physical risk models in order to be able to conduct comprehensive risk assessments that consider the evolving environmental landscape and its potential impact on the long-term financial sustainability and solvency of insurers.2

Insurers are asked to assess material exposure to climate change risks and use at least two climate scenarios to project business development over the short, medium, and long term. Materiality assessment can be done by classifying assets and liabilities into sectors particularly exposed to climate change, such as agriculture, fossil fuels, utilities, energy-intensive industries, transport, and housing. These examples demonstrate a useful starting point for considering the ways climate change affects an insurer’s balance sheet and, ultimately, its solvency position.3

Integrating Physical and Transition Risks

The 2025 assessment from EIOPA shows that insurers have made significant progress in integrating climate change risk into their risk management processes. Unlike in 2021, most insurers now include climate change scenarios in their ORSA - covering both transition and physical risks. Scenario analysis has become central to evaluating the financial impact of these risks, with notable improvements in both quality and depth. More insurers are using quantitative methods and linking climate risk assessments to specific management actions, reflecting greater awareness of the financial importance of climate risks. Additionally, findings from climate risk assessments are increasingly influencing insurers’ strategic decisions. However, challenges like limited data quality and availability, inconsistent models and a big variety in scenario modelling persist and need continuous improvement moving forward.4

In Transition

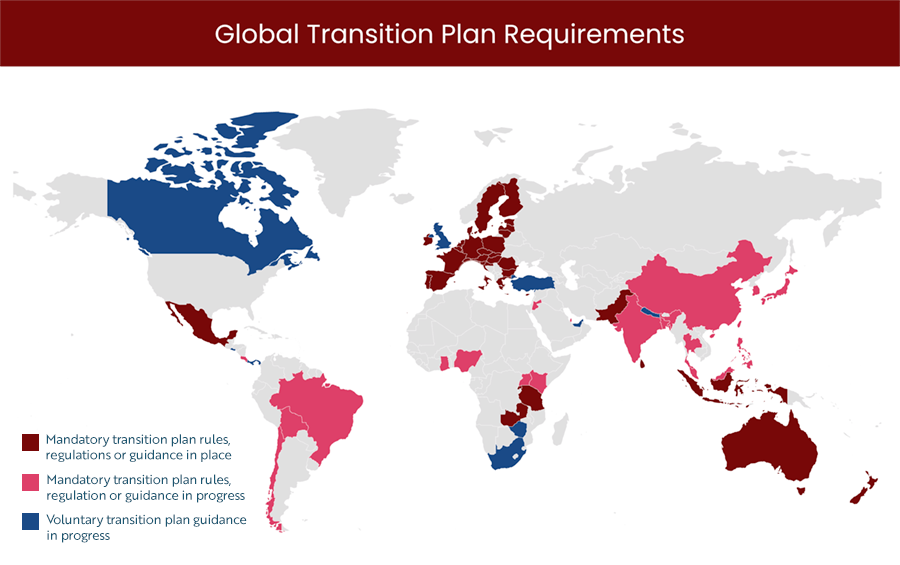

Transition plans are gaining momentum and are a key component of transitioning to a low-carbon, nature-positive economy. The International Transition Plan Network (ITPN) has launched an interactive map to see where countries stand in terms of transition legislation and what the differences are in terms of reporting requirements.

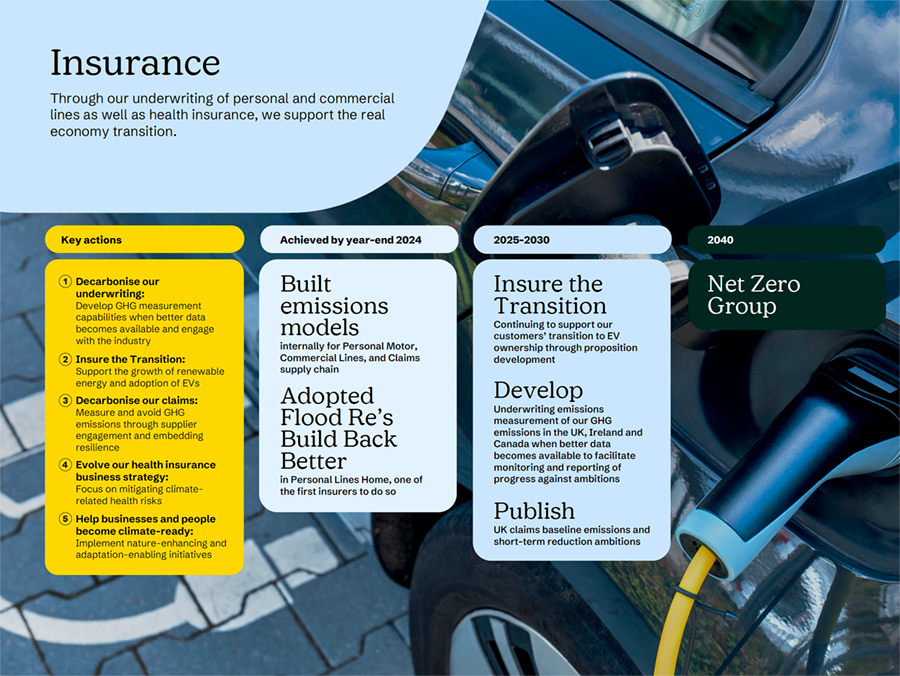

Insurers have started to lay out their transition plans - e.g. Aviva has published one of the most ambitious transition plans with the goal of becoming a net-zero company by 2040. They published the 2nd iteration of a comprehensive plan in February 2025 - Aviva transition plan.

The Next Frontier

Getting sustainability into insurers’ core operations is the next frontier. As of today most efforts to advance sustainability stay in siloed reporting programs. But in order to achieve real added value, sustainability has to move into the core of insurance - into underwriting and claims. Transition plans and risk assessment as required by regulation play a key role in driving this forward.

Getting sustainability factors into underwriting is still at an early stage but with more data points getting available it will add to the granularity of underwriting and improve pricing especially for commercial lines.

In claims management, some insurers have started to measure carbon emissions of various repair options - repair, replace with used parts or repair with new parts - with a clear preference for repair options in terms of carbon emissions and cost. More on sustainable claims solutions for motor and property lines in this blog post on sustainable claims.

As AXA CEO Thomas Buberl puts it: "We must innovate – not for the sake of innovation, but to remain relevant and useful in a world that is changing fast. […] Sustainability is part of this transformation. It is not a separate agenda – it is embedded in how we assess risks, how we design solutions, and how we invest. It is a lever for innovation, and a path to long-term value – for our clients, for our business, and for society."5

Insurance technology partners like Guidewire who cover the whole P&C insurance lifecycle in one cloud platform are the technological foundation for an ecosystem of innovation partners and an integrated sustainability technology solution. With the myriads of new data and analytics solutions becoming available for various aspects around sustainability reporting, climate resilience and the green transition, insurers are often overwhelmed in assessing and curating the right solutions for their needs. Guidewire can help them to shed light on this developing ecosystem with curated apps and content on Guidewire Marketplace - designed to help insurers innovate and stay up to date.

In case you missed it:

Part 1: Regulation as a key driver for sustainability - From duty to value

1 Source: https://www.weforum.org/publications/global-risks-report-2025/digest/

2 Source: https://risksphere.nl/insights/solvency-sustainability-eu-esg-mandate-insurance-companies/

3 Source: https://medium.com/@actuarial-statistical/did-eu-insurers-do-well-on-their-first-climate-related-risk-assessment-97cc6e9be0dc

4 Source: https://www.eiopa.europa.eu/publications/public-statement-monitoring-exercise-use-climate-change-scenarios-orsa_en#description

5 Source: https://www-axa-com.cdn.axa-contento-118412.eu/www-axa-com/43c9962e-0132-4d99-b72e-23a798e7a494_AXA_Unlock_Sustainable_Insurance.pdf