“By analyzing driving data like hard breaking, speed, and time during an accident, telematics can help insurers more accurately estimate damages after an accident and even reduce fraud.” - National Association of Insurance Commissioners

The motor vehicle market is changing and with it, the insurance market. Over the last few years, insurers have begun to adopt telematics via Usage-Based Insurance (UBI) programs and are now showing interest in learning about its value proposition beyond UBI. Exciting new opportunities with telematics in claims management present compelling use cases for both insurers and consumers.

It is time for insurers to innovate using insights from new data sources or risk being left behind. Questions abound: how will insurers handle the connected car; the autonomous car? Where does liability lie? How should pricing and claims methodologies evolve with connected cars expected to dominate the market?

According to Ptolemus, a strategy consulting firm specializing in telematics, the penetration rate of personal telematics insurance policies is estimated to increase from 1.5%, as of December 2015, to 10.3% in 2020. This represents an increase in the number of telematics insurance policies from approximately 12 million today to nearly 90 million in 2020!

With actual driving data strongly influencing the predictability of whether a consumer will have an accident claim or not, telematics now becomes an important factor in the determination of premium pricing. But what about the value of telematics data beyond pricing? Can behavior analysis and claims data be used for predictive analytics and risk management? How is the data directly actionable for the benefit of both insurers and policyholders?

Applying telematics data to detect motor vehicle crashes and optimize resulting claims presents significant advantages for both insurers and policyholders. The insurance industry is still looking at the basics of safer driving through driver education, but there is so much more value to telematics, especially in claims handling. Telematics is also transforming motor insurance at a pivotal industry time, with connected and autonomous cars changing the landscape – cars that drive themselves affect both the need for insurance and liability assignment.

Telematics data can deliver significant incremental value to insurers, including reducing the average cost of claims, and combating fraudulent claims, and improving data aggregation techniques that optimize data from siloed resources. Telematics speeds up the entire claims process, and the sooner an insurer begins to employ telematics for this purpose, the lower the average claims cost – at Octo, we have seen time to settle reduced by more than fifty percent.

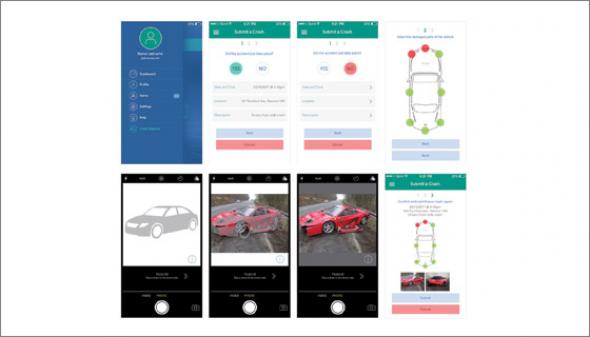

Traditionally, the policyholder controlled the moment at which a claims process started – they would be the party that triggered the claims process. With telematics, the insurer’s claims process begins immediately after crash detection, enabling more control, better customer service, as well as fraud and cost reduction.

A proactive First Notice of Loss (FNOL) service allows the insurance company to react rapidly to an accident, moments after it has happened, so that proactive outbound contact can be made with the policyholder to collect as much information as possible and “freeze” the crash scene. The goal is to minimize the risk of fraud or subsequent third-party intervention in the claim process.

Real time data not only delivers crash recordings, but also information on the following:

Time of impact

Speed

Vehicle location

Vehicle journey at time of crash and g-force

Acceleration/deceleration parameters

Other information to help roadside assistance and emergency services manage the event accordingly.

Telematics gives insurers a complete understanding of a crash - even if only one vehicle involved has the technology. With a deeper data set than ever before, insurers have a better understanding of every crash element, including the ability to drill down to details such as impact force, as well as the likelihood of whiplash and other types of soft-tissue damage.

Telematics insurance policies, on average, result in 50% fewer claims vs. non telematics policies (Ptolemus Consulting Group Data). Moreover, telematics data and proactive FNOL have the ability to improve the claims management process and reduce it by 10-15 days. Data analytics will be critical to understanding what happened - and determining liability –if say, a car with autonomous capabilities engaged collides with a pedestrian.

Combining driver behavior analysis with crash and claims data utilizes the best models of predictive analytics for risk management, personal engagement and underwriting, and benefits insurers through:

Lower claims frequency

Reduced claims costs

Improved customer value proposition

Increased loyalty and stronger retention strategies.

With the right insurance telematics solutions, adjusters are equipped with the best data to assign responsibility in a crash, process claims faster, and significantly minimize fraud. The popularity of telematics in crash and claims is sure to continue to grow in both fighting fraud and finding new avenues of revenue for insurers.

To help insurers understand the reduction in combined ratio from UBI or claims, and to estimate how telematics impacts your combined ratio, please visit Octo Telematics' Financial Impact of Telematics Estimator.