Eyes on anything. Anytime. Anywhere. So you can know what’s true.

Anyone who is a parent of a teenager, pre-teen, kindergartener, etc., or just a parent in general, will instantly relate to WeGoLook’s tag line. Read on to learn about how, as a carrier, you can also have eyes on any risk at any time.

Who

WeGoLook has a distributed, on-demand network of 30,000 professional “Lookers” who can rapidly capture photos, record videos, and perform custom tasks, including drone inspections.

A Looker can be any of the following:

Licensed drone pilots

Registered notaries

Licensed adjusters and appraisers

Certified mechanics

Professional photographers

Bilingual communicators

Their Value Proposition

WeGoLook Insurance has 3 different offerings:

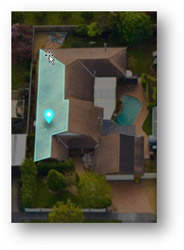

The risk assessment Look provides carriers with the images and information they need to make informed decisions about underwriting risks. The below photo was taken by a Looker drone pilot.

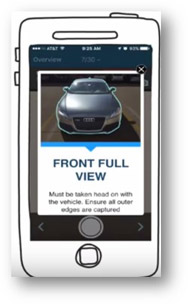

The claims inspection Look gets eyes on vehicle and property damage, as well as loss scenes, in record time, giving carriers the information they need to move things forward.

Document services deliver and ship documents. For example, a total loss. Carriers can deploy Lookers to complete all the needed on-site tasks and delivery of final documents for signature and insurance settlement checks.

The Opportunity

WeGoLook is capitalizing on the on-demand economy trend by engaging qualified professionals that are in close proximity to risk locations. By leveraging these Lookers, carriers can dramatically increase their visibility into risks and loss scenarios, as well as provide faster claims settlement and policy servicing through document servicing.

WeGoLook COO Kenneth Knoll will be a participant on our Connections panel, “InsurTech Innovation - What’s New for the Digital Insurer” on Wednesday, November 15, 2017 at 3:45 p.m. in Margaux meeting room #2.