Imagine you’re trying to ski down a mountain as quickly and safely as possible. Within any given ski run, there are an almost infinite number of routes that you could take. So how do you decide which path is best for you? Perhaps the most obvious plan of attack is to take a look downhill and decide based on common sense and the previous times that you’ve skied the same run.

The problem with this approach, of course, is that you’re limiting yourself to what you can see and factoring in only your own experiences and biases. A better approach might be to look at how others have skied the same terrain and then try to imitate those who have had the most success based on as many common characteristics as possible (time of day, weather conditions, date, etc.). If you want to take your skiing to another level, you could even use AI to analyze all of the previous runs and map out your optimal route. Analytics for the win!

But hold on — there are other questions to answer. When and where do you want this information? Do you want to see what you could’ve done better last Tuesday, or would you rather get feedback in real time, when it can impact the decisions that you’re making right now? Logic dictates that analytical insight is more valuable if it’s actionable. And the best way to make insight actionable is to surface it when and where decisions need to be made.

Based on where you’re reading this, you probably won’t be surprised to hear that this philosophy has applications that extend into insurance. In fact, Guidewire’s approach to analytics is predicated on the belief that analytical insight is the most valuable when it’s embedded into core processes.

You can see evidence of Guidewire’s commitment to embedding analytics insights into core processes with each new release, and Elysian is no exception.

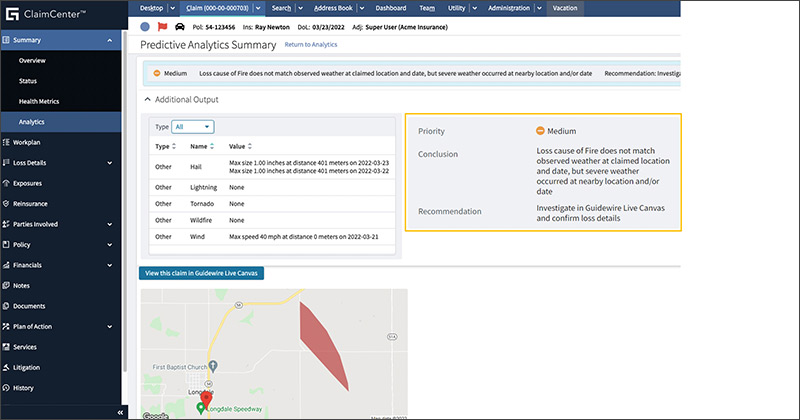

ClaimCenter now pulls weather discrepancy alerts from Canvas. This means that your core system can automatically identify and flag claims that have weather inconsistencies. It’s worth noting that the power of embedded analytics is the combination of the insight itself and the fact that the user doesn’t have to go searching for it. Claims adjusters could certainly manually check weather conditions for every new claim, or they could look at a report regularly to identify which claims warrant further investigation based on weather conditions and the loss cause on each claim. But either approach would be inefficient and error prone, and the insight would come at a suboptimal time to actually influence the outcome of the claim. Embedding the insight directly in ClaimCenter is a multiplier.

In PolicyCenter, improved integration with HazardHub embeds even more analytical insight into the underwriting process. HazardHub feeds more than 1,400 data elements into PolicyCenter, which is a potentially overwhelming amount. To make it actionable, PolicyCenter groups the data and displays it in simple but meaningful ways. This enables underwriters to understand, assess, and price risk more intelligently. And because they can do it all directly in PolicyCenter, the value of the insight is multiplied.

These are just a couple of examples of how Guidewire has been multiplying the value of analytical insight by embedding it into core processes. You should expect to see even more coming in our Flaine release — and beyond.

The line between core capabilities and analytics continues to blur, and this is a good thing for the industry. Or at least it’s a good thing for any insurers that seek to get down the mountain as quickly and safely as possible.