InsuranceNow: Guidewire Core Platform for MGAs

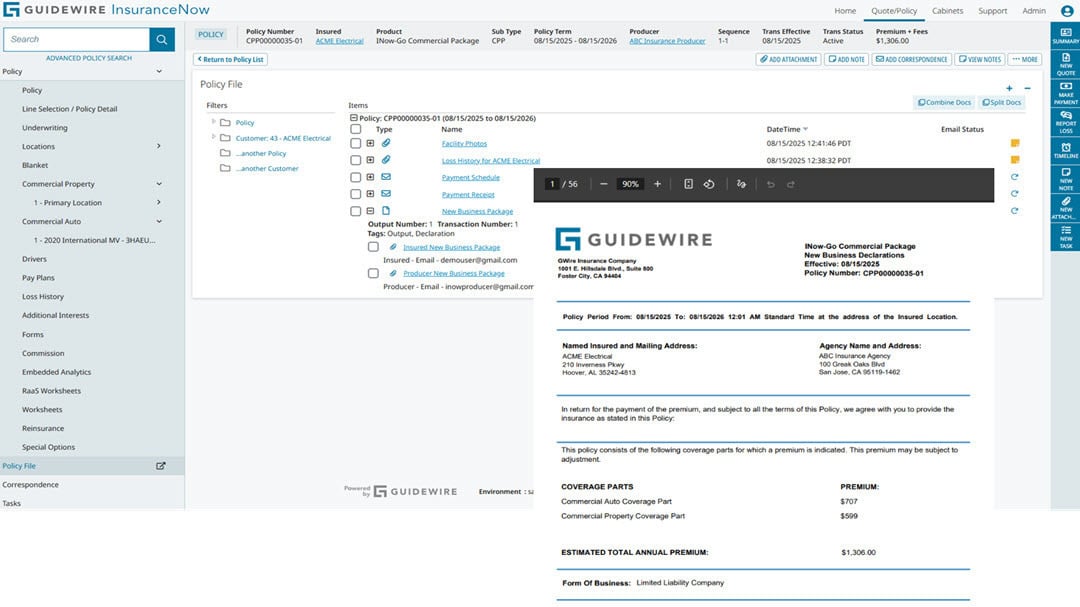

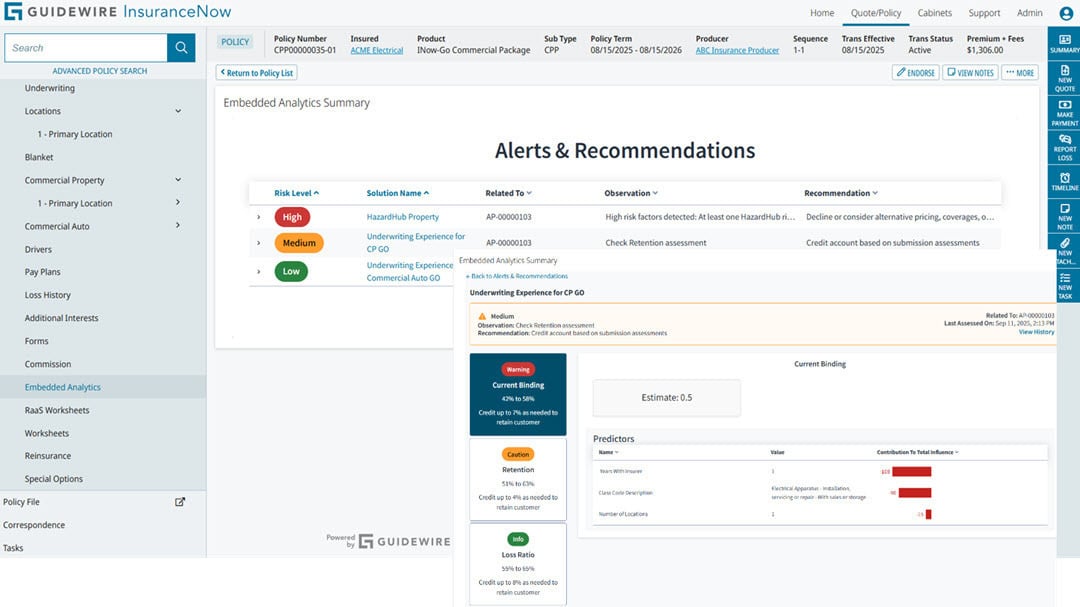

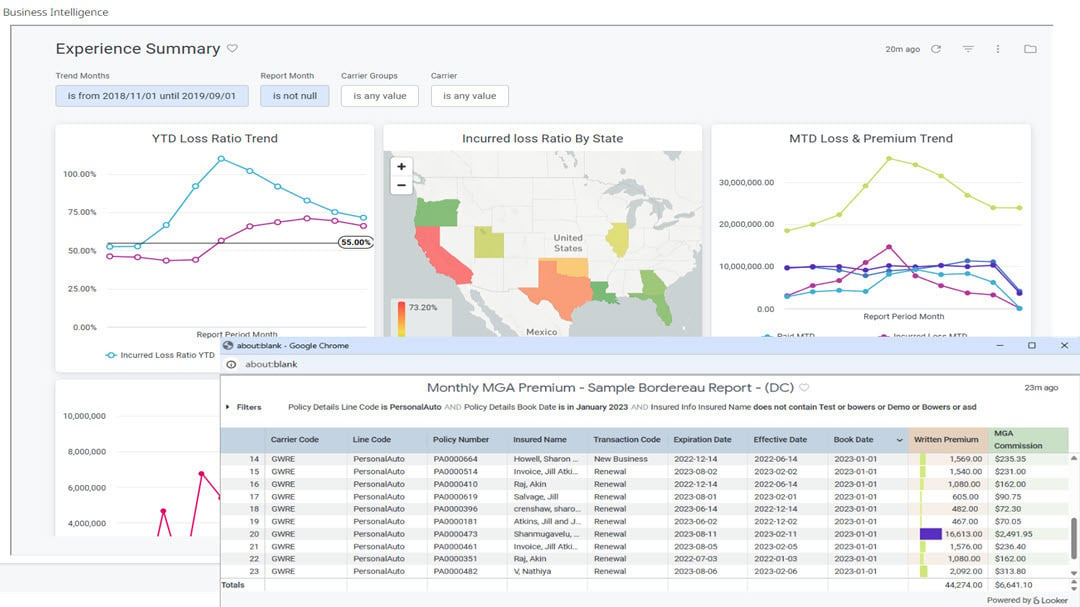

Ideal for MGAs prioritizing speed, simplicity, and operational efficiency over extensive customization, InsuranceNow delivers predefined templates and ready-to-use integrations that streamline setup, reduce, overhead, and enable faster program launches, especially for standard or niche personal and commercial lines.