In the U.S., insurance is regulated state by state—a structure that can feel fragmented and burdensome, but one rooted in longstanding legal precedent and the belief that local conditions require local oversight. This article focuses on personal lines and offers a primer on how state-based regulation works, why rate filings exist, the tradeoffs they create, and what they cost insurers. We also outline the institutions that support the filing process and highlight how efficient analytics and rate implementation can help insurers stay agile despite regulatory delays.

Why Insurance is Regulated By State

The U.S. was founded as a union of sovereign states, and a central question during the creation of its founding documents was around how much of that sovereignty should be transferred to a centralized government. This basic fact means that the states in the U.S. typically have jurisdiction over activity in their own territory as long as it doesn’t affect other states.

A counter-example would be business that operates across state lines. “Interstate commerce” is federally regulated because that activity crosses boundaries and requires consistent national rules. But the history of insurance is one of smaller insurers selling insurance to customers in each state, and in the 1800’s insurance was judged to be an intrastate business. Each state had the primary place in regulating insurance within their borders.

As insurers grew in size and increasingly operated in multiple states, that status quo was challenged (successfully!) in court in the 1940’s. Rather than face the uncertainty that would ensue from radically changing the existing situation, the U.S. Congress passed the McCarran-Ferguson Act in 1945, which clarified and confirmed the states as having authority over insurance transactions.

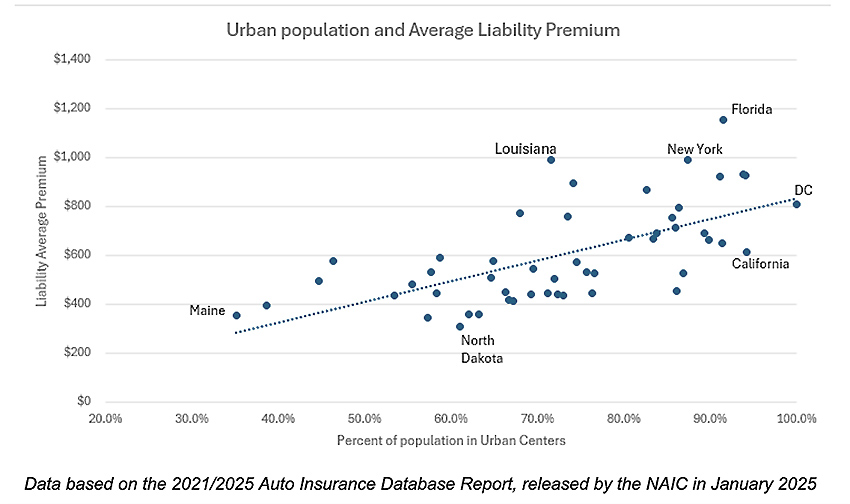

While the current system increases the complexity of insurance regulation, it is also better situated to respond to diverse conditions in the different states. See the chart below which correlates how much of a state’s population is urban to average Auto liability premiums. Two ideas behind the preservation of state sovereignty are experimentation and local differences. With states responding differently to the same issues, a grand experiment could be seen in each success or failure, with each state learning from the others’ experience. At the same time, each state could respond to their local conditions whenever they found that a different approach worked better for their situation. Both of these ideas can be seen in the state-level regulation of insurance in the U.S.

A Focus on Rates

Insurance regulation includes the entirety of the business of insurance, from overall solvency to the way insurers conduct business in the market. Regulators want to know that customers are being treated fairly with respect to claims and that customers looking for insurance are not turned away from the opportunity to buy. While insurance regulation includes all of this, this blog focuses specifically on price regulation (rates) through rate filings.

With some exceptions, insurance regulators in the U.S. require that the method of determining a prospective customer’s premium be filed. Premium is typically determined through a rating plan, a collection of rules that turn information about the customer into the premium that the insurer would charge such a customer. This rating plan, along with the forms to be used, are what regulators want on file, along with justification for why those rates are appropriate.

The primary goal of regulators is to maintain a healthy insurance market, allowing residents in their state to obtain coverage that is reliable and affordable. Thus they concern themselves with both the solvency and the competitiveness of insurers, looking for rates that are high enough to keep the insurer in business and low enough to be affordable for the insured. Recently, regulators have been increasingly considering the fairness of the rates as well.

These three considerations are reflected in the actuarial principle adopted by the Board of Directors of the Casualty Actuarial Society (CAS) in 1988 that rates should be not inadequate, not excessive, and not unfairly discriminatory.

In the U.S. there is also widespread agreement among regulators that premiums should be based on identifiable customer characteristics, ones that clearly relate to the risk of a loss. Two customers with the same risk characteristics must typically be charged the same rate. This limits the use of demand models in the U.S., though considerations of up-front expenses versus lifetime value can still be used to justify rate differences.

Once finalized, filings are generally open to the public, ensuring a certain level of transparency in the rates that insurers charge. Certain parts of the rating plan can usually be filed as a trade secret, protecting the insurer’s intellectual property, although the rules for this vary by state. For example, if an insurer has developed its own method for calculating credit scores and linking credit information to expected insurance losses, it will want to keep that a trade secret to maintain a competitive advantage. Insurers can attempt to file that as “proprietary and confidential”. In states where this is not allowed, insurers may choose to file a different, more generic credit score to preserve their advantage in other states that do allow confidentiality.

The Downside of Rate Filings - Delay

Filing rate plans allows regulators a chance to review them. Regulators are interested in changes to the overall rate level, and they will scrutinize trend selections and other adjustments made to the data. Regulators also want a chance to review changes to existing rating factors and implementations of new factors. Different states will have interest in different parts of the rating plan based on what is considered relevant issues for their customers.

One of the most important impacts of requiring rate filings is the subsequent delay between analysis and implementation. Insurance pricing is an exercise in using past experience to predict the cost of insurance in the future. The filing process means that predictions must be made for a more distant, and therefore inherently more unknown, future.

Consider a line of business, such as Homeowners, with a year-long policy term. Even if rates could be changed daily, once an insured has purchased a year of coverage the premium paid needs to be adequate for the entire life of the policy. Thus the rates need to target the expected cost six months after purchase for the entire term to be appropriately priced.

Now consider that historical data used for determining these rates are typically, at best, three months old. This is because insurers want to make sure that even the recent historical policies have (almost) all of their losses reported. And let’s assume that the analysis itself takes three months. At this point, the span of time between the historical experience and the target expected loss date is a full year - a three month gap to allow losses to be reported, another three for modeling, and six months to target the middle of the effective period.

One year. But even this doesn’t take into account the programming delays that implementations of the new rates can require, nor the need to have renewal rates in place 1-2 months prior to the effective date in order to give customers time to renew. With a cumbersome legacy rating engine, these considerations can easily extend the gap to 18 months.

As the time lag between the data and target date increases, the uncertainty of the prediction increases with it, and the ability of the insurer to respond to changes in the market decreases. Some of this is in the control of the insurer - a modern pricing software that integrates efficient analysis with integrated rating can take months off of the schedule. But the biggest cost of rate filings is that months more can be added to this time gap because of the filing process and the need for regulatory review.

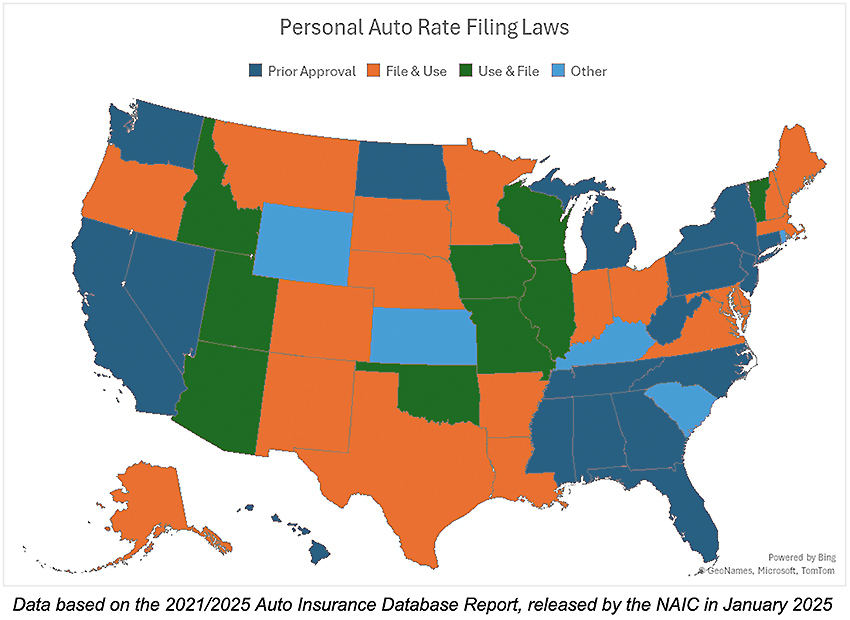

The length of time required for regulatory review varies by state. This is primarily due to the attitudes of the Departments of Insurance (DOI) in each state, but there are three general variations for basic filing requirements:

- Prior Approval (PA) - rating plans must be filed with the Department of Insurance and cannot be used in practice until approved.

- File and Use (FU) - rating plans must be filed with the Department of Insurance before being put into practice, but once this is done the rates can be used, even if not yet approved.

- Use and File (UF) - rating plans can be put into practice at will, but the Department of Insurance still expects that a filing be made in a timely fashion.

Note that each state has its own specifics, and there are variations that do not fit neatly into these categories. The graphic below displays state groupings based on the characterizations developed by the National Association of Insurance Commissioners (NAIC).

Note that these rule differences do not mean that there is no approval process in FU and UF states. What this means is if the insurer has already implemented rates that are subsequently disallowed, they may owe customers refunds. Because of this, many insurers like to get approval before use, regardless of the state’s regulatory practices.

Regardless of the official variations, insurers filing in the U.S. must get to know the regulators and their practices in each state. Some take more interest in rate filings than others, and some invest more time and resources into reviewing them than others.

Working with U.S. Regulators

The state-based regulatory system increases the cost of doing business for insurers. Those who write policies in multiple states will need to be familiar with the rules and expectations of each one. At the same time, each Department of Insurance wants to implement regulations that are manageable, because a healthy insurance marketplace is good for consumers. Insurance regulators do what they can to work with insurers in a reasonable fashion.

For example, each Department of Insurance has a website with information for customers and insurers in their state. These sites typically include filing rules, procedures, and contact information. While most filings are, officially, a collection of documents - submissions of intent, followed by questions or objections, followed by answers in reply - most regulators welcome inquiries from insurers to discuss potential issues. The personal touch is more collaborative and efficient than a series of objections/responses.

Regulators across states also come together in a group, the NAIC, which aims to bring some consistency to insurance regulation. The NAIC forms groups to address on-going issues, such as the Financial Condition Committee, and emerging ones, such as the Big Data and AI Working Group.

The work of the NAIC’s committees allows regulators to debate regulatory approaches while getting industry and consumer input. Model rules and regulations are produced which can then be adopted by multiple states, helping to bring consistency to insurance regulation. Another product of the NAIC is SERFF,the System for Electronic Rate and Form Filing. States and insurers both use this system to facilitate filings.

Navigating U.S. Insurance Rate Filings

Given the size and diversity of the U.S. population, regulating insurance by state is understandable. National regulations, though on the surface more efficient for insurers to navigate, would have a difficult time giving appropriate guidance to insurance in both Florida and Idaho. Regulations which would be much more detailed than needed in New Mexico might be woefully insufficient for the complexities of New York. State-level regulation allows the governments in each state to create a process that fits.

Insurers also can customize their approaches to different states. Regional insurers can choose to write in only those states that align with their approach and value proposition to customers. National insurers can implement new ideas in a phased manner, getting proof of their success before rolling it out across the country.

But the compliance costs in time and effort are real. Insurers should not underestimate these for risk of making the difficulties worse. Insurers should work collaboratively with regulators to find ways to make the filing process more efficient.

Guidewire PricingCenter can help in the U.S. market. Because all insurers are subject to the same regulation, insurers should maximize the efficiency of their internal processes around data extraction, analysis, and implementation. PricingCenter’s powerful analytics and friction-free connection between the analytic environment and the rating engine allows insurers to reduce the time lag between data and implementation. And simplifying the processes that insurers can control provides them with more time and energy to navigate the complexities of the market.

Learn More

Discover how PricingCenter streamlines analysis and rating implementation to help insurers navigate U.S. rate filings with greater efficiency.