Measure in order to manage

“You can’t manage what you don’t measure” is a well known statement that is the very foundation and driving force behind sustainability reporting and regulation. In a world that has been used to financial reporting for decades or even centuries, new parameters and data points like carbon emissions or water usage that we need in order to measure sustainability are still unchartered territory. In that regard, the world has been fast in establishing new reporting paradigms within years. The main driver behind it: regulation.

According to Anna Petersen, Director of KPMG Norway, the “global insurance sector is demonstrating a clear and accelerating commitment to sustainability reporting”.1 European companies are leading the adoption of new mandatory standards like the CSRD / ESRS (Corporate Sustainability Reporting Directive and European Sustainability Reporting Standards) which are driving more standardized and comparable disclosures. A significant focus in these regulations is on climate-related financial disclosures, including net-zero commitments and detailed transition plans. In 2025 the UK launched the UK Sustainability Reporting Standards (UK SRS) - they are based on the global IFRS (International Financial Reporting Standards) standard with a few regional amendments and will thus closely align with a globally used standard.2

However, a big portion of global insurers are still reporting on a voluntary basis along frameworks like GRI (Global Reporting Initiative) or IFRS. Sustainability reports are increasingly including more in-depth analysis like various climate scenarios and comprehensive greenhouse gas emissions data as well as transition plans. Also information around nature and biodiversity are gaining in importance but are still at an early stage across the globe.

Sustainability standard for insurers

In recent years, financial institutions around the world have worked together and formed a new initiative called PCAF in order to develop a unique financial industry reporting standard. With PCAF, insurers can implement a harmonized approach to assess and disclose insurance-associated greenhouse gas (GHG) emissions. The first version of the standard provides detailed methodological guidance for the measurement and disclosure of GHG emissions associated with two segments - personal motor lines and commercial lines. This Standard is Part C of the overall Global GHG Accounting & Reporting Standard for the Financial Industry. Global insurance groups like Allianz, AXA, Aviva, Generali, Liberty Mutual, Lloyds, Munich Re, QBE, Swiss Re, Tokio Marine and Zurich are among the 16 members of the PCAF Insurance-Associated Emissions Working Group.3

Taking nature into equation

Nature and biodiversity loss have been identified as one of the main risks affecting communities and supply chains across the globe. The good news is that these risks are rising up the agendas of European insurers. With more and better data points becoming available technology plays a key role in measuring impact on natural assets. This makes it much easier for insurers to comply with regulatory requirements to report on various topics like water resources, pollution, restoration, deforestation etc. Start-ups like Nature Alpha, Gentian or Kuyua provide data and analytics on nature and biodiversity that insurers can use for reporting as well as underwriting.

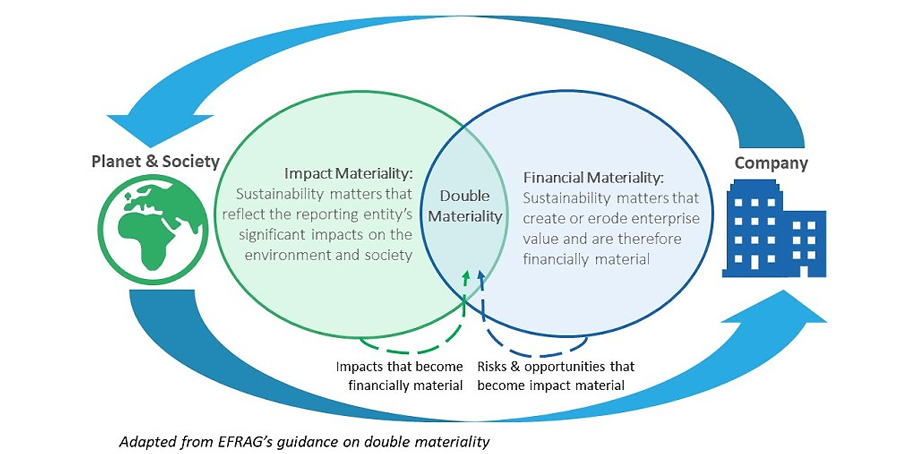

EU - double materiality for a broader perspective

The EU has established a double materiality perspective - which means companies are obliged to report both on their impacts on people and the environment (inside-out or impact perspective), and on how environmental and social issues create financial risks and opportunities for the company (outside-in or financial perspective).4 Implementing double materiality goes beyond reporting - it demonstrates an insurer’s commitment to sustainable practices across the business.5

Most European insurers have adopted the double materiality assessment and published findings and results - as this example from Generali nicely illustrates - Double Materiality Assessment.

Insurers onboard for Omnibus

In order to simplify and streamline reporting obligations of companies, the EU has introduced the so-called Omnibus packages. With these changes across several legislations like the CSRD, the EU wants to ensure that reports focus more on meaningful information and eliminate unnecessary bureaucratic burdens.6 The stop-the-clock initiative postpones reporting deadlines and obligations for small and medium enterprises significantly.

Insurers are affected by this new development in two ways - as an EU corporation for their reporting obligations and as an underwriter of commercial risks. With a big part of SMEs being affected by the omnibus, underwriters will lack data when assessing sustainability- related risks of companies, commercial properties and other related risks. If no or only limited data is available it could lead to insurance exclusion of certain risks or at least to high insurance prices for certain risks in the small and medium segment.7

Whereas most insurers and insurance associations like the GDV8 support the EU omnibus effort in order to lower their reporting obligations, there are also voices like the Eurosif9 who raise concerns regarding a backlash for decarbonization and the nature-positive transition.

Spain has just introduced a new legislation for mandatory climate disclosure for companies and public entities operating in Spain - providing clarity when EU regulation is in flux. Spain is reacting to more frequent and severe climate impacts including record-breaking temperatures, wildfires, and floods – which hit Spain over the last years. Starting in 2026, a large number of companies either incorporated in Spain or conducting business there will be required to report their greenhouse gas (GHG) emissions and publish credible reduction plans.10We will see over the next few years how focusing on material aspects and lower reporting burdens will really make a difference for the impact of insurers on planet and people while staying economically viable.

AI - game changer for reporting and beyond

While Omnibus will lower the reporting burden for EU insurers - reporting tasks will remain a challenge with new regulation and analytics requirements entering the scene.

New capabilities around data and AI will help to deliver on transparency, speed and ease of sustainability reporting - this will gain even more importance as granularity and complexity in sustainability is increasing with more and more data points getting available.

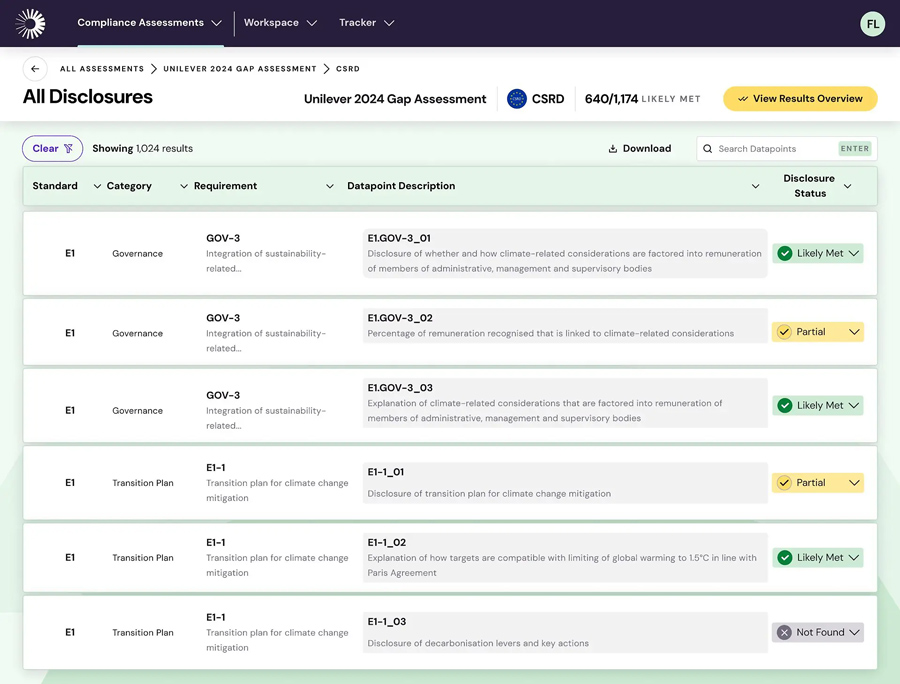

With AI, insurers can streamline data and research capabilities and automate gap analysis and benchmarking. AI supported real-time intelligence helps them to analyse and compare disclosures instantly. Companies like Manifest Climate provide sustainability intelligence including gap-analysis against several reporting standards. Data points from the ESG analysis can be leveraged for underwriting in commercial lines.

And when insurers get this data at hand in their core underwriting system or cloud capability they will be able to underwrite better risks faster and price risks more accurately.

Uncover the value

Overall, regulation and reporting on sustainability is often felt to be a burden while the sense of value is falling behind. However, it enables companies not only to comply with regulation and fulfill their reporting duties - but it helps them to better understand their business and impact for more sustainable business models, ecosystems and society at large. Companies that not only comply with sustainability regulation but lead with purpose for sustainability will gain in brand reputation and attract the young generation more easily - customers as well as talents.

Sustainability practices are increasingly linked to improved financial results. Businesses that prioritize sustainability efforts often experience lower expenses due to more efficient resource utilization and better waste management. Moreover, these practices can create new avenues for sustainable offerings, fostering innovation and boosting revenue.11

Insurers with risk management at the heart of their business model are highly impacted by climate and sustainability related risks but also have great levers to advance resilience and the green transition. In the second part of this blog series we will discuss how regulation can drive insurance sustainability to new horizons.

1Quelle: https://www.linkedin.com/pulse/sustainability-reporting-practices-worlds-largest-anna-pettersen-0nqqf

2Quelle: https://davidcarlin.substack.com/p/a-practical-guide-to-uk-sustainability

3Source: https://carbonaccountingfinancials.com/en/standard#c

4Source: https://www.actuarieelgenootschap.nl/actueel/navigating-sustainability-understanding-double-materiality-in-insurance

5Source: https://www.gdv.de/gdv-en/topics/regulation/the-eu-s-omnibus-packages-why-they-matter-for-insurers-190666

6Source: https://www.kennedyslaw.com/en/thought-leadership/article/2025/the-impact-of-the-omnibus-on-corporations-and-insurers/

7Source: https://www.eurosif.org/press-room/eurosif-warns-omnibus-proposals-risk-undermining-investment-and-competitiveness/

8Source: https://www.iss-corporate.com/resources/blog/spain-introduces-mandatory-climate-disclosure/

9Source: https://instituteofsustainabilitystudies.com/insights/guides/sustainability-reporting-the-many-advantages-for-businesses