Scott Belsky, the former chief product officer at Adobe, once said about innovation:

“It's not about ideas. It's about making ideas happen.”

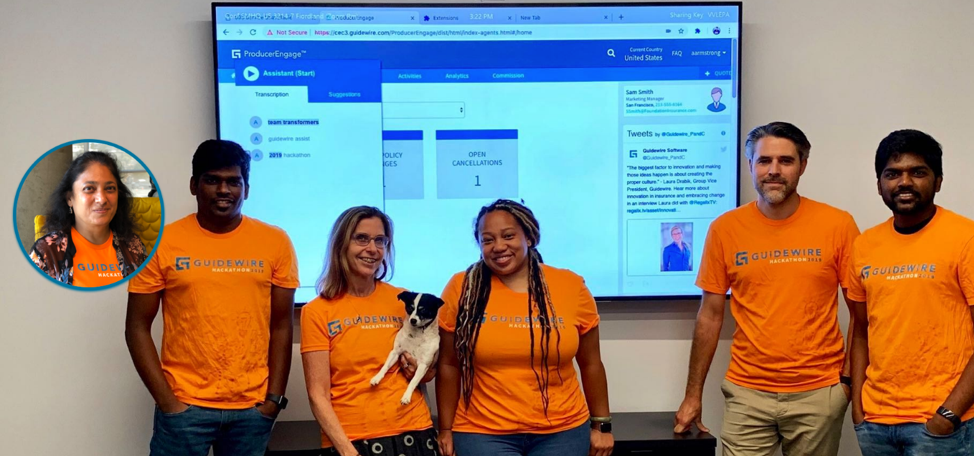

As the Group VP of Innovation at Guidewire, I had the incredible experience of participating in our revamped and relaunched developer hackathon in July 2019. Serving as both a mentor and a judge, I came out of the experience energized by the creativity and skill of our Product Development team. At Guidewire, we run hackathons to innovate our solutions. It’s a mechanism to ensure that ideas happen. The winning ideas from our hackathons don’t just sit on a shelf collecting dust; they move into pilots that we investigate for absorption into our products. Allow me to share the top three ideas from our hackathon.

1. IoT-Driven Claims Automation

Team name: LeekFixers

The winning team, LeekFixers, leveraged a “roost” water leakage device to trigger a claim in ClaimCenter and then automatically fulfill the entire claims process from FNOL to payment to closure in ClaimCenter without any adjuster intervention. Of course, the team also automatically triggered texts to the insured via Twilio to keep them connected to the claims process. When demonstrating their hack in the final presentation, they creatively placed the roost in a plate of water. Then the automation unfolded!

2. Empathetic Claims Intake

Team name: Transformers

Leveraging Google Transcription when capturing an FNOL, Google translates what the insured is saying on the phone into a capture box found on the side of the loss screen. The transcription is then stored as a document in the claim file. The Transformers team also “leveraged” Google Transcription to configure the process to automatically detect the right type of loss, pull over the appropriate policy into the claim, and recognize and prefill the location and details into FNOL from the transcription. This use case is just as relevant for policy processing, since it can also be used to transcribe notes live as the customer service representative (CSR) is talking to the policyholder on the phone. By leveraging transcription for document details on an FNOL or policy process, the adjusters, agents, and CSRs can concentrate on serving customers and not logging notes into a system.

3. Visual Representation of a Claim, Policy, or Household

Team name: Fogo

Working closely with our insurers, I often hear how important it is for an underwriter, adjuster, supervisor, or any key stakeholder to come up to speed quickly on a policy, claim, or customer file. Imagine the pressure on representatives when they try to do this while taking a live call! Team Fogo developed a hack that centralizes the most important data in one place so that it’s easily and quickly accessible to key stakeholders. The hack visually displays the relationship of all claim and policy information to objects in the file. An insurer stakeholder no longer has to waste time clicking between multiple screens to find the appropriate details; just use Claim Lens, Policy Lens, or Account Lens and click the element you’re interested in to see the details you need.

Thank you to our Development team, in particular Umang Jain, for driving this revamped hackathon! This is how we innovate—we make ideas happen.