London Market Tech Barometer 2026: The State of Modernisation, AI, and Data

Table of Contents

- 1. Executive Summary

- 2. Insurer Technology Is Driving Broker Placement Decisions

- 3. Firms Are Modernising Without Waiting for Blueprint Two

- 4. AI Helping Brokers Enhance Efficiency, Aid Data Ingestion

- 5. Growth Is Concentrating in Complex, Data-Intensive Lines

- 6. Algorithmic Underwriting Is Here To Stay

- 7. Claims Management Remains the Least Digitised Part of the Value Chain

- 8. Conclusion: The Speed of Modernisation is Defining Market Winners

- 9. Methodology

1. Executive Summary: A Market Moving at Two Speeds

The London Market has reached a structural inflection point. What was once framed as future readiness now determines whether insurers are relevant to brokers today. The 2026 Guidewire London Market Tech Barometer shows that the market’s future is being built now, and waiting for market wide initiatives is no longer a viable strategy. Delays in modernization now carry an increasingly severe competitive and commercial cost.

We surveyed more than 250 London Market brokers for the Guidewire London Market Tech Barometer 2026, and the message to insurers is clear: technology is now a deciding factor in brokers’ placement strategy. An overwhelming 78% of respondents say an insurer’s technological capability is either a very significant competitive advantage or the deciding factor when placing business. In a market where brokers have choice, inefficiency is exclusionary.

This pressure to modernize is unfolding against a complex market backdrop. While confidence in the London Market’s long-term position remains high, with over 37% of respondents "very confident" in its 10-year outlook, nearly 70% describe current market conditions as soft or softening. At the same time, capacity growth is concentrating in complex, data-intensive lines such as professional liability and cyber.

When it comes to modernization, market pioneers have stopped waiting for a silver bullet. Following repeated delays to Blueprint Two, a clear majority of market participants are forging their own path, prioritizing internal agility over market-wide consensus. The London Market appears to be moving away from convergence on a single future operating model. As firms modernize at different speeds, those that move faster are increasingly shaping the standards that others will have to align to.

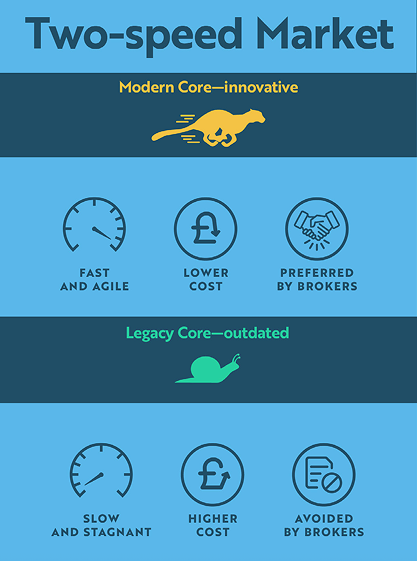

A two-speed market is emerging. Insurers investing in modern core platforms, automation, and data connectivity are not only outperforming their peers today, but also better positioned to respond to broker expectations, operate efficiently in a soft market, and compete in growth lines that reward speed and data quality. Those that delay modernization risk losing business today and competitiveness over the long term.

2. Insurer Technology Is Driving Broker Placement Decisions

Broker loyalty is no longer anchored in history or relationships alone. The survey data confirms that decisions are increasingly shaped by speed, integration, and ease of doing business.

Technology now wins business. Nearly four in five (78%) brokers surveyed say insurer technology plays a decisive or highly significant role in where they place risk. This is even more significant among senior brokers and director-level respondents, demonstrating that this is not merely an operational nice-to-have, but a strategic filter applied by experienced decision-makers.

Legacy systems are the primary blocker. When asked to identify the single biggest impediment to modernisation in the London Market, reliance on outdated technology ranked the highest. In a softening market, the survey suggests brokers are becoming more attuned to efficiency and increasingly favour technologically advanced insurers.

On the other hand, insurers that require brokers to navigate disconnected portals, re-key data multiple times, or rely on email-driven workflows are increasingly deprioritised.

78%

When you are choosing an insurer to place business with, how significant an impact does an insurer's technological capabilities have on your placement/distribution strategy?

3. Firms Are Modernising Without Waiting for Blueprint Two

The delays to Blueprint Two have catalysed a shift in mindset. Rather than stalling investment until a market-wide standard is perfected, firms are taking matters into their own hands.

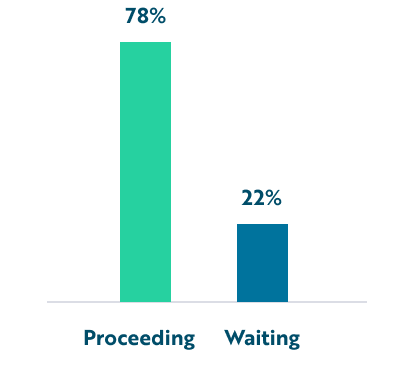

The market isn't waiting. A considerable number of respondents (78%[1]) indicate that they are proceeding with their own technology strategies regardless of the Blueprint Two timeline.

This momentum also introduces a new interoperability risk. Among those moving ahead independently, 31% of respondents express concern about insurers’ ability to integrate due to legacy core constraints.

The market is becoming more pragmatic, and progress can no longer wait for perfection. Insurers delaying core modernisation risk becoming structurally misaligned with broker-led workflows that are already taking shape.

[1] Combining answer options “We are proceeding with our own technology strategy, regardless of the market's timeline.” and “We are proceeding with our own technology strategy, but are concerned about interoperability (i.e. carriers' ability to integrate with brokers)”.

4. AI Helping Brokers Enhance Efficiency, Aid Data Ingestion

Brokers have a clear view of where AI delivers immediate value – the focus is squarely on efficiency and data ingestion.

Maximising Intake Agility: The top AI use case cited by brokers surveyed was automating submission intake and data extraction (42%), followed by enhancing exposure management (38%). This demonstrates that the most compelling AI use cases today focus on moving unstructured data efficiently into core systems.

The Trust Gap: While brokers welcome efficiency, they remain wary of the "black box". A significant 55% expressed concern about algorithmic bias and lack of transparency in risk selection.

Across senior respondents, AI investment priorities consistently skewed toward activities that directly drive placement volume and commission, reinforcing the pattern that revenue generation takes precedence over post-bind service transformation.

For which of the following tasks do you believe AI offers the most immediate benefit in the London Market?

5. Growth Is Concentrating in Complex, Data-Intensive Lines

Growth expectations in the London Market remain positive, but brokers are increasingly clear that expansion is concentrating in specific lines of business rather than being evenly distributed.

Growth is increasingly concentrated in complex, data-intensive classes. Brokers identify professional liability and cyber as the lines most likely to see significant growth over the next five years, reflecting demand for coverage in lines where risks are changing rapidly and data requirements are high.

These growth areas are more challenging for legacy operating models. Success in cyber and professional liability depends on the ability to ingest, analyse, and act on data quickly. This need exposes the limitations of manual processes, fragmented systems, and inconsistent data foundations.

Ironically, cyber as a risk exposure is somewhat of a double-edged sword for some insurers. Brokers cite cyber both as a top growth opportunity and identify cyber attacks as one of the biggest risks facing London Market insurers, tied with growing competition from other regions.

6. Algorithmic Underwriting Is Here To Stay — Data Quality Will Determine Trust and Scale

The growth of algorithmic underwriting is no longer a future ambition in the London Market, but its effectiveness depends on foundations that are still uneven.

Algorithmic underwriting is already a significant and growing reality. Over half of brokers (51%) say the shift toward algorithmic or fully digital underwriting is happening now, and nearly half (48%) view ‘smart follow syndicates’ positively for their ability to speed up placement, signaling increasing automation in underwriting workflows.

Data quality and consistency are the primary constraints on confidence and scale. More than a third of respondents (37%) point to fragmented standards as a leading cause of poor data quality, while the largest single group of respondents (29% ) rate a mandatory market-wide data standard as essential.

This highlights both the potential and the challenges for some insurers seeking to explore algorithmic underwriting. Without consistent data flowing into core systems, algorithmic underwriting risks remaining efficient in theory, but difficult to trust and scale in practice.

This shift also has important implications for market-wide standards. While brokers have historically been sceptical of initiatives such as the Core Data Record, the strength of these responses suggests sentiment is changing. The challenge now is ensuring that standards improve data quality and usability in practice, rather than introducing additional friction.

7. Claims Management Remains the Least Digitised Part of the Value Chain

While insurers have made progress modernising placement and underwriting, that progress has not been evenly applied across the value chain. Claims is where operational debt becomes most visible to customers, yet it ranks low on the modernisation agenda.

Respondents most frequently cite excessive or repetitive paperwork (26%) and slow settlement times (20%) as the primary sources of customer frustration during the claims process. These findings point to continued reliance on manual and fragmented workflows long after binding. This frustration is even more pronounced at senior levels: more than two in five (41%) senior respondents citing repetitive processes and slow settlement times as the primary sources of client dissatisfaction during claims.

Investment priorities remain skewed toward the pre-bind space. Senior respondents prioritise AI and automation for submission intake (29%) and market search (26%), while a smaller percentage (19%) identify claims management as a priority area for AI investment.

In a softening market, where competition for renewal business intensifies and broker choice increases, the survey suggests that underinvestment in claims represents a growing strategic blind spot with direct implications for retention and reputation. Claims processing remains an important insight-driven feedback loop into underwriting decision making, which is critical in a softening market.

8. Conclusion: The Speed of Modernisation is Defining Market Winners

The Guidewire London Market Tech Barometer 2026 findings depict a market that is confident in its future, but growing impatient.

Brokers are no longer waiting for a market-wide modernisation push, and they have made it clear that they will deepen their partnerships with insurers who move faster, integrate more easily, and reduce friction across the value chain.

The growth opportunities are real, particularly in professional liability, cyber and potential new lines of business. But capturing them requires more than new products. It requires a modern core system capable of supporting speed, transparency, and interconnectivity.

Insurers that delay modernisation in the hope of future standardisation risk finding themselves misaligned with the market that emerges. Those that act now are already outperforming their peers, strengthening broker relationships, and positioning themselves for growth in high-value lines. Most importantly, they are beginning to shape the future of the London Market.

9. Methodology

This survey was conducted by Censuswide among 251 insurance brokers working primarily with London Market insurers. The survey took place between 19.11.25 and 27.11.25. Censuswide abides by the Market Research Society’s Code of Conduct, based on ESOMAR principles, and is a member of the British Polling Council.

Like this report?

Become a data-driven, digital organisation with the power to improve risk selection, reduce losses, enhance communication, and satisfy every customer. Learn more about Guidewire in the London Market.

Learn More