Guidewire UnderwritingCenter

Dynamic Workflows for

Better Underwriting Decisions

Shift the underwriting paradigm from a static, wait and process approach to an intelligent, dynamic, event-driven workflow that automatically guides submissions through the underwriting lifecycle, minimizing manual processes and freeing underwriters to focus on what matters most: making expert, judgment-driven decisions and structuring profitable deals with confidence.

Redefined Risk Selection

Powered by AI

UnderwritingCenter is an AI-driven, cloud-native application designed for P&C commercial lines underwriters who are overwhelmed by high-volume submissions and fragmented systems. It provides a flexible, unified experience to assess complex risks and select profitable ones across the entire pre-bind journey. Insurers can achieve:

Improved Efficiency

Intelligently guide submissions through a dynamic workflow, freeing underwriters from low-value, manual tasks.

Increased Profitability

Empower underwriters to make better judgments and select more profitable risks by delivering accurate, informed insights.

Reduced IT Risk

Minimize the operational risks that come from disconnected systems through deep integration with the Guidewire platform and policy administration systems.

Enhanced Broker Experience

Drive efficient collaboration with brokers and internal stakeholders for faster quote turnaround times and improved broker relationships.

Intelligent Underwriting from

Submission to Bind

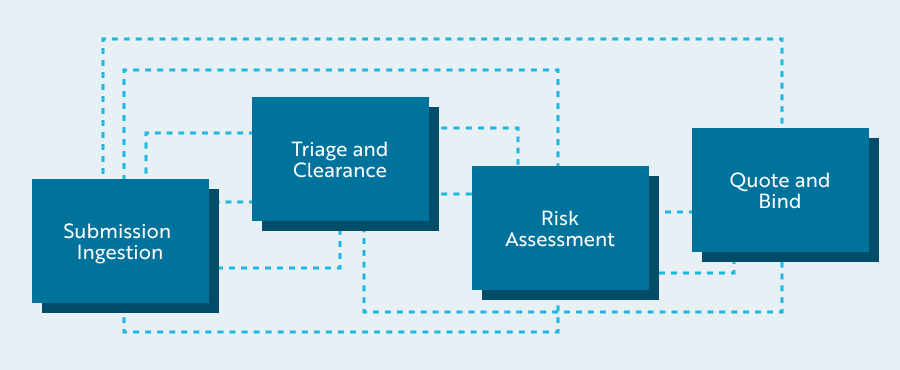

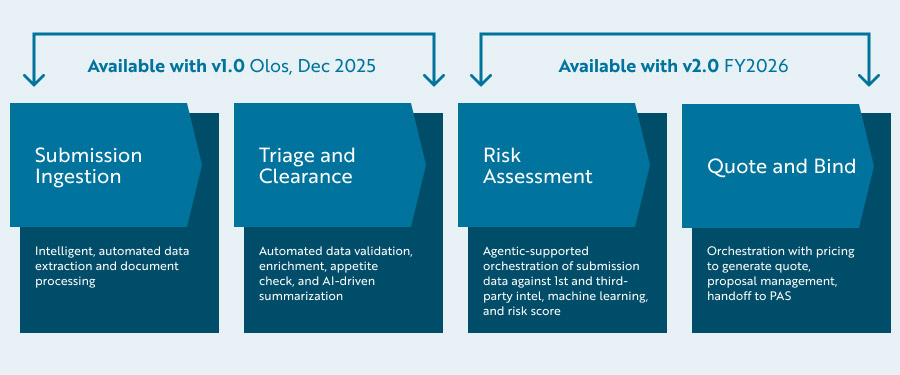

Point solutions available in the market only address a fraction of the underwriting process. Use UnderwritingCenter to drive better, faster, and smarter decisions from submission to selection to bind: Start with AI-driven data extraction, enrichment, and summarization. Accelerate triage and clearance to help underwriters quickly identify out-of-appetite risks. Access a unified view of all submission data, predictive scores, and insights for strategic risk analysis. Seamlessly orchestrate the handoff to the policy administration system for issuance.

Agentic Underwriting Built on Guidewire Cloud Platform

Turn Submissions Into Decisions

UnderwritingCenter is built on Guidewire’s Agentic Framework, an enterprise agentic platform that lets insurers securely build, run, and govern P&C Insurance-specific agents.

The agents used in UnderwritingCenter help turn submissions into decisions by accelerating intake and triage, enriching data, performing enhanced clearance checks, and providing underwriters a clear view of risk.

1

Submission Ingestion

The Submission Ingestion Agent automatically extracts and normalizes data from unstructured documents, turning every submission into a standardized digital record. It automates ingestion and enrichment by supplementing extracted data with online research and third-party risk scores.2

Triage and Clearance

The Triage Agent automatically assesses risks against underwriting guidelines to easily identify "out-of-appetite" submissions and the Clearance Agent validates broker license, retrieves data from PAS, and performs regulatory and sanctions checks. This automated process frees underwriters from manually sifting through submissions that should be quickly declined.3

Risk Summarization

UnderwritingCenter provides an actionable, enriched, and comprehensive summary of new risks. It synthesizes all relevant information into a clear view that acts as the foundational first step for evaluating risks.4

Faster Initial Decisions

Get to an initial "yes" or "no" decision faster with AI-powered summaries and triage, collapsing the time required for initial review from hours to minutes. This dramatically improves efficiency and enables underwriters to be more responsive to brokers.

Guidewire Is a Connected Experience