Guidewire (NYSE: GWRE) today announced its financial results for the fiscal quarter ended October 31, 2025.

“We continue to see strong momentum for Guidewire Cloud Platform and we are off to a great start to the fiscal year,” said Mike Rosenbaum, chief executive officer, Guidewire. “This momentum was clear at our annual customer conference, Connections, where we launched new pricing and underwriting products that deliver intelligence and AI powered automation to P&C insurers.”

“First quarter results came in above the high end of our outlook on all metrics and informs our confidence to raise our outlook ranges for the fiscal year,” said Jeff Cooper, chief financial officer, Guidewire. “ARR growth of 22% year-over-year reflects the strong sales momentum we have established.”

First Quarter Fiscal Year 2026 Financial Highlights

Revenue

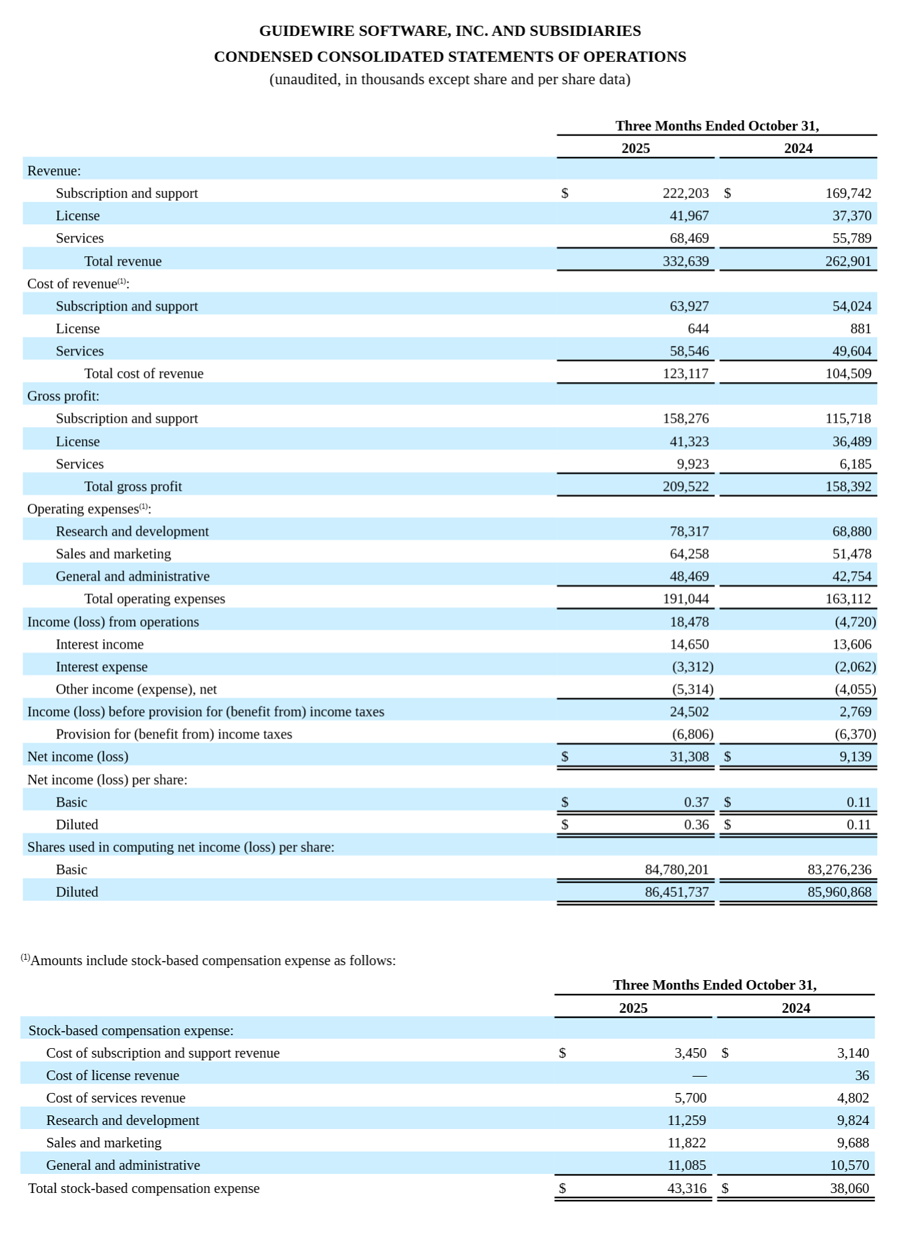

- Total revenue for the first quarter of fiscal year 2026 was $332.6 million, an increase of 27% from the same quarter in fiscal year 2025. Subscription and support revenue was $222.2 million, an increase of 31%; license revenue was $42.0 million, an increase of 12%; and services revenue was $68.5 million, an increase of 23%, each compared to the same quarter in fiscal year 2025.

- As of October 31, 2025, annual recurring revenue, or ARR, was $1,063 million, compared to $1,041 million as of July 31, 2025. ARR results for interim quarterly periods in fiscal year 2026 are based on actual currency rates at the end of fiscal year 2025, held constant throughout the year.

Profitability

- GAAP income from operations was $18.5 million for the first quarter of fiscal year 2026, compared with GAAP loss from operations of $4.7 million for the same quarter in fiscal year 2025.

- Non-GAAP income from operations was $63.4 million for the first quarter of fiscal year 2026, compared with $34.7 million for the same quarter in fiscal year 2025.

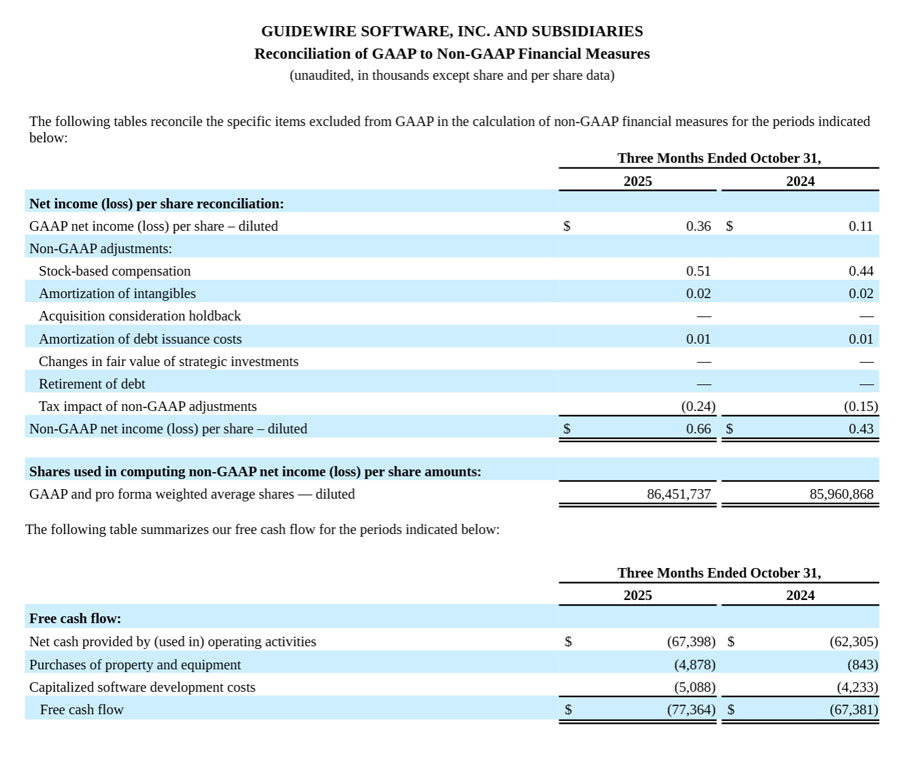

- GAAP net income was $31.3 million for the first quarter of fiscal year 2026, compared with $9.1 million for the same quarter in fiscal year 2025. GAAP diluted net income per share was $0.36 for the first quarter of fiscal year 2026, based on diluted weighted average shares outstanding of 86.5 million, compared with GAAP diluted net income per share of $0.11 for the same quarter in fiscal year 2025, based on diluted weighted average shares outstanding of 86.0 million.

- Non-GAAP net income was $57.0 million for the first quarter of fiscal year 2026, compared with $36.7 million for the same quarter in fiscal year 2025. Non-GAAP diluted net income per share was $0.66 for the first quarter of fiscal year 2026, based on diluted weighted average shares outstanding of 86.5 million, compared with non-GAAP diluted net income per share of $0.43 for the same quarter in fiscal year 2025, based on diluted weighted average shares outstanding of 86.0 million.

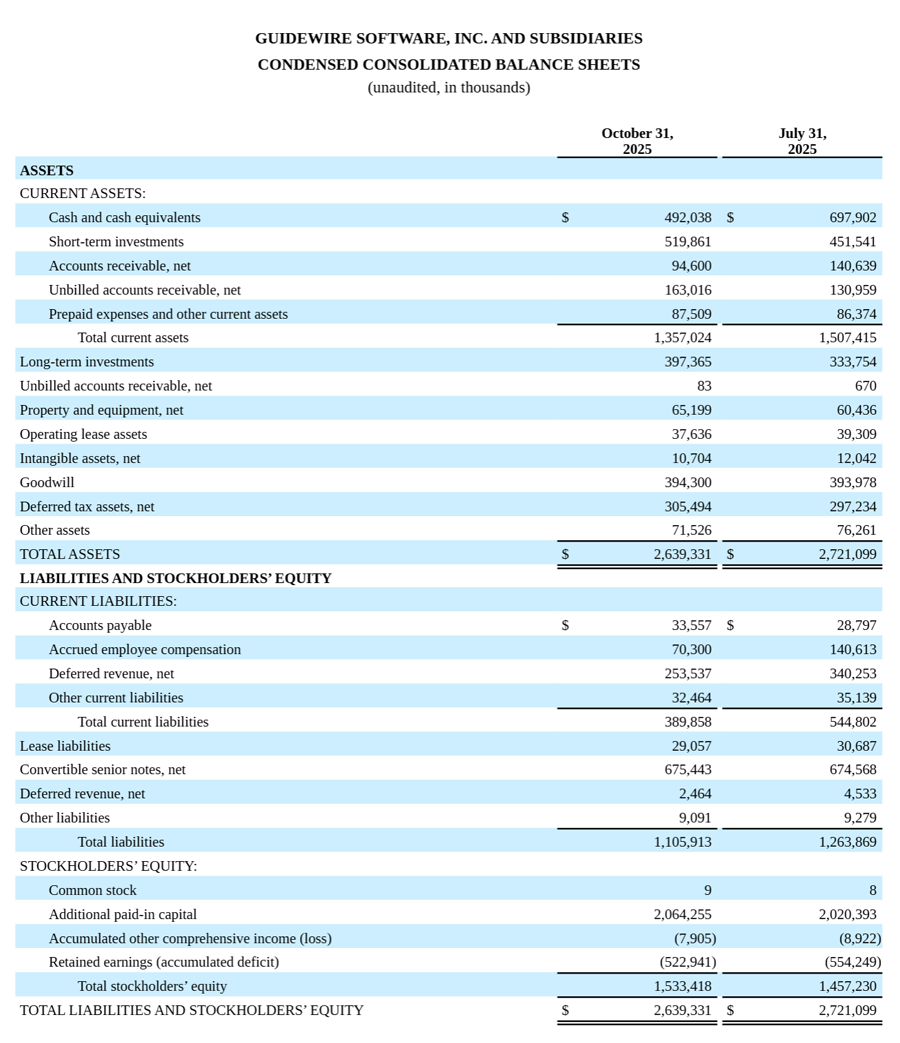

Liquidity and Capital Resources

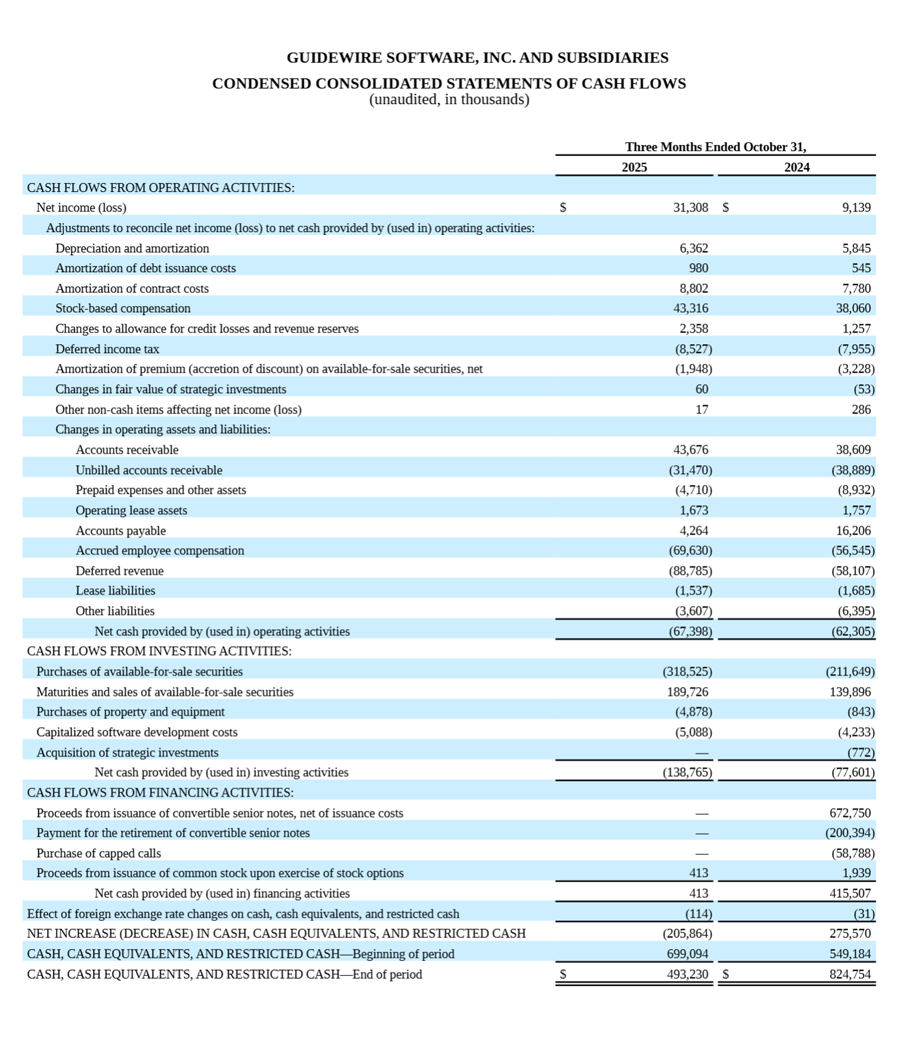

- Guidewire had $1,409.3 million in cash, cash equivalents, and investments at October 31, 2025, compared to $1,483.2 million at July 31, 2025.

Business Outlook

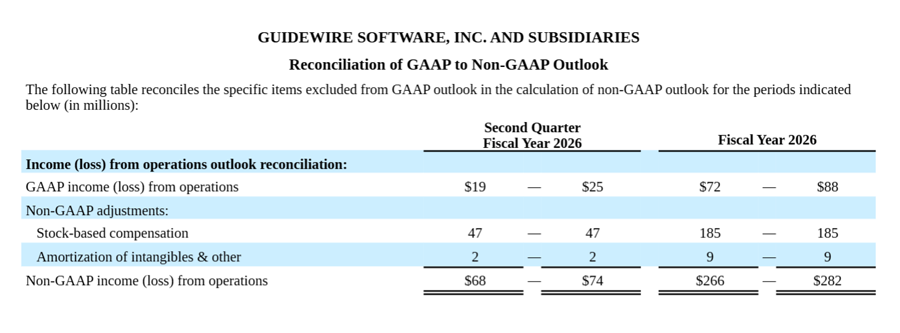

Guidewire is issuing the following outlook for the second quarter of fiscal year 2026 based on current expectations:

- Ending ARR between $1,107 million and $1,113 million

- Total revenue between $339 million and $345 million

- GAAP operating income between $19 million and $25 million

- Non-GAAP operating income between $68 million and $74 million

Guidewire is issuing the following updated outlook for fiscal year 2026 based on current expectations:

- Ending ARR between $1,220 million and $1,230 million

- Total revenue between $1,403 million and $1,419 million

- GAAP operating income between $72 million and $88 million

- Non-GAAP operating income between $266 million and $282 million

- Operating cash flow between $355 million and $375 million

Conference Call Information

| What: | Guidewire First Quarter Fiscal Year 2026 Financial Results Conference Call |

| When: | Wednesday, December 3, 2025 |

| Time: | 2:00 p.m. PT (5:00 p.m. ET) |

| Dial-in: | (669) 444-9171 |

| Meeting ID: | 930 0540 5680 |

| Password: | 589958 |

| Webcast: | http://ir.guidewire.com/ (live and replay) |

The webcast will be archived on Guidewire's website (www.guidewire.com) for a period of three months.

Non-GAAP Financial Measures and Other Metrics

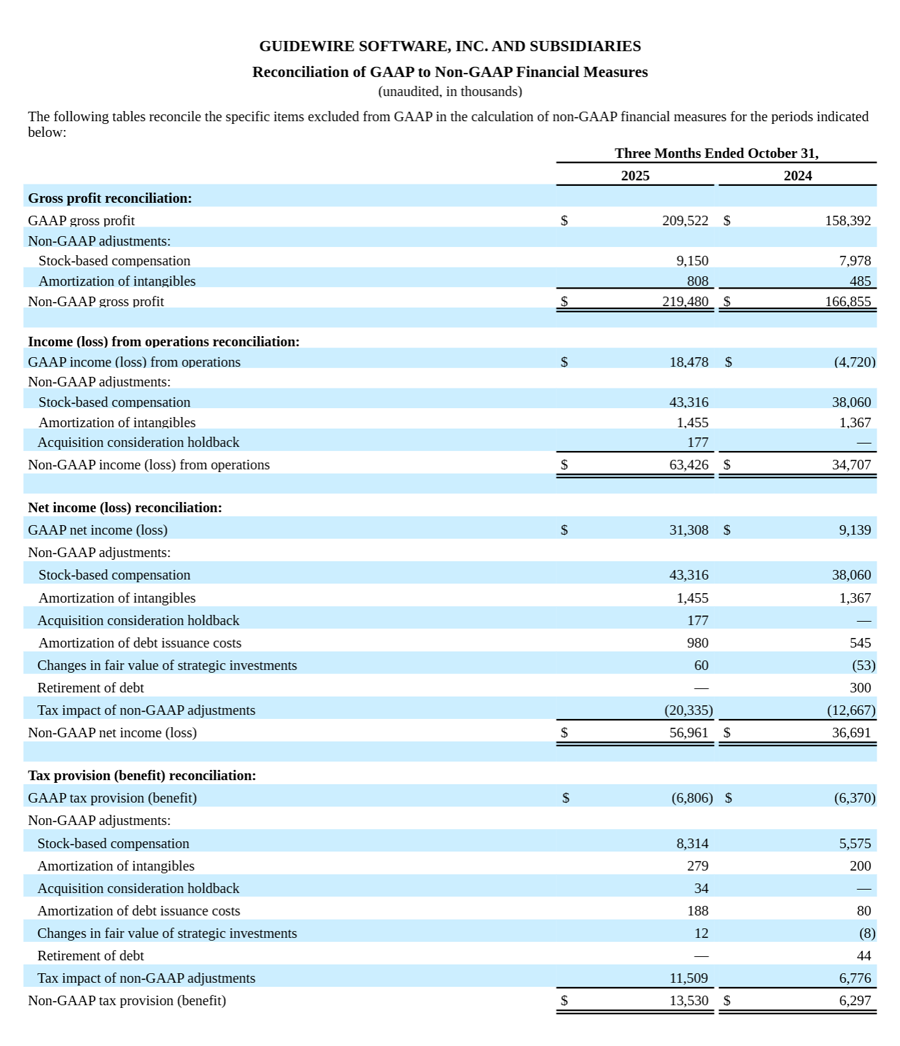

This press release contains the following non-GAAP financial measures: non-GAAP gross profit, non-GAAP income (loss) from operations, non-GAAP net income (loss), non-GAAP tax provision (benefit), non-GAAP net income (loss) per share, and free cash flow. Non-GAAP gross profit and non-GAAP income (loss) from operations exclude stock-based compensation, amortization of intangibles, and acquisition consideration holdback. Non-GAAP net income (loss) and non-GAAP tax provision (benefit) also exclude the amortization of debt issuance costs from our convertible senior notes, changes in fair value of strategic investments, gain (loss) on sale of strategic investments, retirement of debt, and related tax effects of the non-GAAP adjustments. Free cash flow consists of net cash flow provided by (used in) operating activities, less cash used for purchases of property and equipment and capitalized software development costs. These non-GAAP measures enable us to analyze our financial performance without the effects of certain non-cash items such as amortization and stock-based compensation.

Annual recurring revenue (“ARR”) is used to quantify the annualized recurring value outlined in active customer contracts at the end of a reporting period. ARR includes the annualized recurring value of term licenses, subscription agreements, support contracts, and hosting agreements based on customer contractual terms and invoicing activities for the current reporting period, which may not be the same as the timing and amount of revenue recognized. ARR reflects all fee changes due to contract renewals, non-renewals, expansion, cancellations, attrition, or renegotiations at a higher or lower fee arrangement that are effective as of the ARR reporting date. All components of the licensing and other arrangements that are not expected to recur (primarily perpetual licenses and professional services) are excluded from our ARR calculations. In some arrangements with multiple performance obligations, a portion of recurring license and support or subscription contract value is allocated to services revenue for revenue recognition purposes, but does not get allocated for purposes of calculating ARR. This revenue allocation generally only impacts the initial term of the contract. This means that if we increase arrangements with multiple performance obligations that include services at discounted rates, more of the total contract value would be recognized as services revenue, but our reported ARR amount would not be impacted. During the three months ended October 31, 2025, the recurring license and support or subscription contract value recognized as services revenue was $3.6 million.

Guidewire believes that these non-GAAP financial measures and other metrics provide useful information to management and investors regarding certain financial and business trends relating to Guidewire’s financial condition and results of operations. Guidewire’s management uses these non-GAAP measures and other metrics to compare the Company’s performance to that of prior periods for trend analysis, for purposes of determining executive and senior management incentive compensation, and for budgeting and planning purposes. Guidewire believes that the use of these non-GAAP financial measures and other metrics provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing Guidewire’s financial measures with other software companies, many of which present similar non-GAAP financial measures and other metrics to investors.

Guidewire’s management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in Guidewire’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by management about which expenses and income are excluded or included in determining these non-GAAP financial measures. Guidewire urges investors to review the reconciliation of its non-GAAP financial measures to the comparable GAAP financial measures, which it includes in press releases announcing quarterly financial results, including the financial tables at the end of this press release, and not to rely on any single financial measure to evaluate Guidewire’s business.

About Guidewire

Guidewire is the platform P&C insurers trust to engage, innovate, and grow efficiently. More than 570 insurers in 43 countries, from new ventures to the largest and most complex in the world, rely on Guidewire products. With core systems leveraging data and analytics, digital, and artificial intelligence, Guidewire defines cloud platform excellence for P&C insurers.

We are proud of our unparalleled implementation record, with 1,700+ successful projects supported by the industry’s largest R&D team and SI partner ecosystem. Our marketplace represents the largest partner community in P&C, where customers can access hundreds of applications to accelerate integration, localization, and innovation.

Guidewire uses its Investor Relations website (ir.guidewire.com), X feed (@Guidewire_PandC), and LinkedIn page (www.linkedin.com/company/guidewire-software) as a means of disclosing information about the company and for complying with its disclosure obligations under Regulation FD. The information that is posted through these channels may be deemed material. Accordingly, investors should monitor these channels in addition to Guidewire's press releases, filings with the Securities and Exchange Commission, public conference calls, and webcasts.

NOTE: For information about Guidewire's trademarks, visit www.guidewire.com/legal-notices.

Cautionary Language Concerning Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding our financial outlook, guidance, product strategy, market opportunities, and financial performance. These forward-looking statements are made as of the date they were first issued and were based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. Words such as “expect,” “anticipate,” “should,” “believe,” “hope,” “target,” “project,” “goals,” “estimate,” “potential,” “predict,” “may,” “will,” “might,” “could,” “intend,” variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond Guidewire’s control. Guidewire’s actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to, risks detailed in Guidewire’s most recent Forms 10-K and 10-Q filed with the Securities and Exchange Commission (the “SEC”) as well as other documents that may be filed by Guidewire from time to time with the SEC. In particular, the following factors, among others, could cause results to differ materially from those expressed or implied by such forward-looking statements: fluctuations in our quarterly and annual operating results; our reliance on sales to, and renewals from, a relatively small number of large customers and the related substantial negotiating leverage of these customers; the length and complexity of our sales, product development, and implementation cycles; our competitive environment and changes thereto; our ability to effectively manage international expansion; issues in the development and use of artificial intelligence and machine learning technologies and the related evolving regulatory environment; our making long-term pricing commitments in our customer contracts based on available information and estimates about our future costs that may change; our ability to expand adoption of our cloud-based products and services, and the risk that any of our established products may fail to satisfy customer demands or maintain market acceptance; seasonal and other variations related to our customer agreements and related revenue recognition may cause significant fluctuations in our results of operations, ARR, and cash flows; our ability to develop, introduce, and market new and enhanced versions of our products and services; our ability to retain existing and hire new personnel, including managing a hybrid and geographically distributed workforce; errors or failures in our products or services, as well as service interruptions or failure of the third-party service providers we rely on; our ability to sell our services and products is highly dependent on the quality of our professional services and third-party global system integrators partners; use of AI by our workforce may present risks to our business; our services revenue produces lower gross margins than our license, subscription and support revenue; the impact of global events (including, without limitation, ongoing global conflicts, inflation, high interest rates, economic volatility, political uncertainties, tariffs, bank failures and associated financial instability, and supply chain issues); data security breaches of our cloud-based services and products or unauthorized access to our employees’ or our customers’ data; the impact of new regulations and laws (including, without limitation, security, privacy, AI and machine learning, tax regulations and laws, and accounting standards); assertions by third parties that we violate their intellectual property rights; and other risks and uncertainties. Past performance is not indicative of future results. The forward-looking statements included in this press release represent Guidewire’s views as of the date of this press release. Guidewire anticipates that subsequent events and developments will cause its views to change. Guidewire undertakes no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking statements should not be relied upon as representing Guidewire’s views as of any date subsequent to the date of this press release.

Contacts

Investor Contact:

Alex Hughes

Guidewire

+1 (650) 356-4921

ir@guidewire.com

Media Contact:

Melissa Cobb

Guidewire

+1 (650) 464-1177

mcobb@guidewire.com

###