P&C Insurance Software Core Products

PolicyCenter

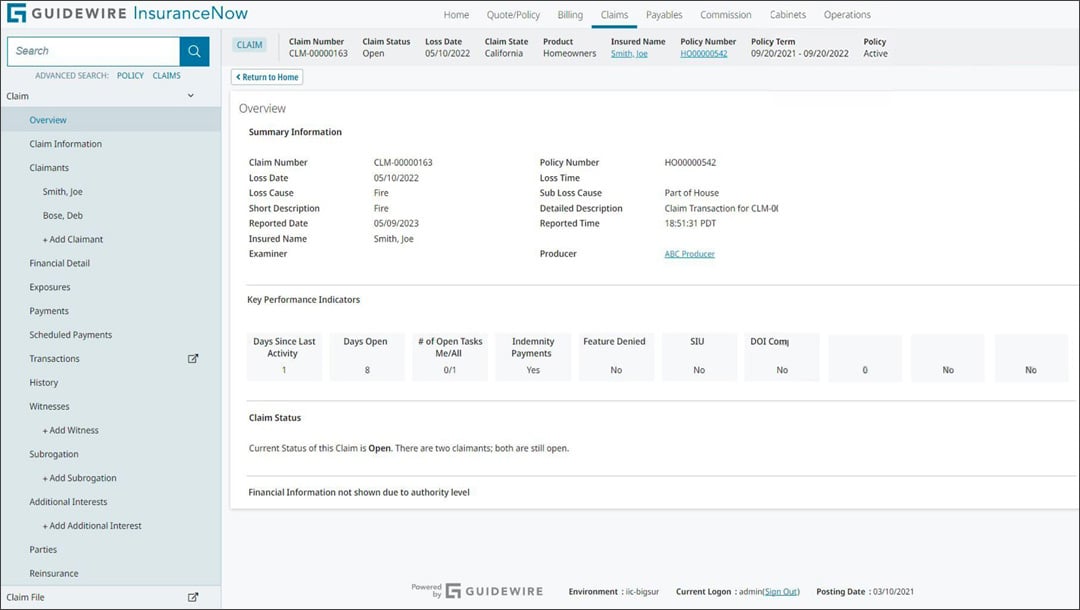

ClaimCenter

BillingCenter

PricingCenter

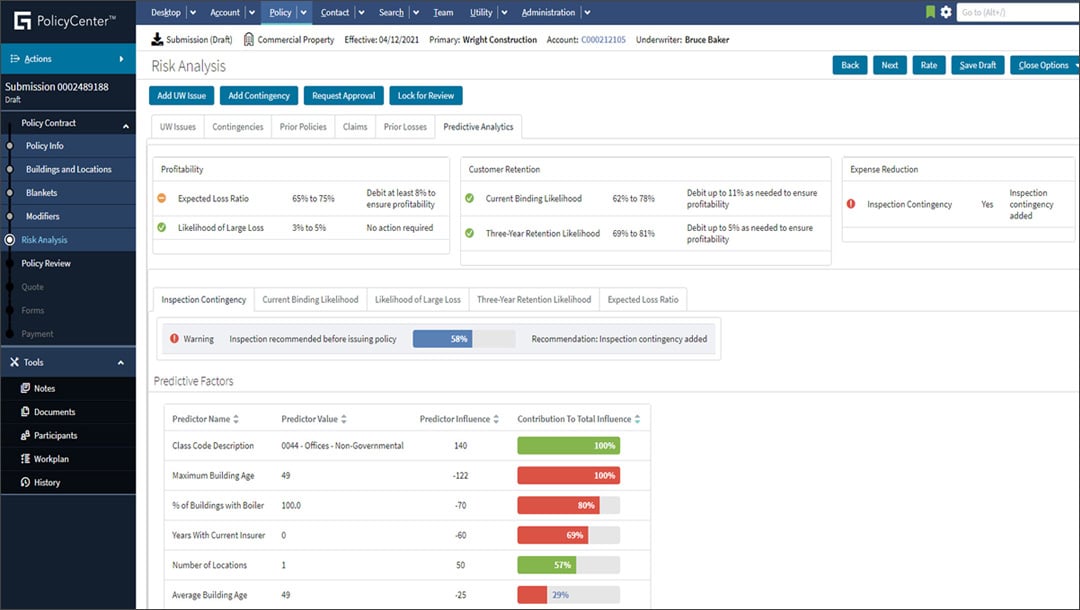

UnderwritingCenter

InsuranceNow

Modernizing P&C Insurance for a

Digital, Data-Driven Future

P&C insurers face nonstop change. Customers expect more, distribution models keep evolving, and new risks emerge as climate and regulation shift. To stay ahead, insurers need a core platform that adapts alongside them and builds lasting trust with every interaction.

Guidewire is the P&C insurance software platform insurers rely on to adapt and lead.

- 540+ insurers in 40 countries run on Guidewire

- 1,600+ successful implementations worldwide

- The largest R&D team in the P&C industry

- The broadest partner ecosystem, delivering hundreds of pre-built integrations

Guidewire Insurance Software Core Products Overview

InsuranceSuite

Our core platform for P&C insurers. InsuranceSuite brings together PolicyCenter, ClaimCenter, and BillingCenter through Guidewire Cloud to power the full insurance lifecycle. Built to give mid-sized and large insurers the flexibility and scale they need for smooth, connected operations

Learn More

InsuranceNow

An end-to-end platform built for regional and super-regional insurers and MGAs. Comes ready with pre-configured lines of business so teams can launch quickly and grow with confidence

Learn More

Connected Applications Built for What Insurers Do Every Day

InsuranceSuite includes Guidewire Centers. These purpose-built applications handle critical insurance functions like policy, billing, claims, underwriting, and pricing. Together, they form a connected core system that gives insurers the flexibility to adapt and keep pace with change.

What Guidewire Core Products Deliver

Designed to help insurers work more efficiently and improve customer experiences to stay competitive in a changing market

- Respond quickly to market shifts and adapt with ease as new regulations or opportunities appear

- Automate routine tasks and using accurate, accessible data to move faster and make better decisions

- Improve every touchpoint with faster quoting, transparent claims handling, and flexible payment experiences

- Launch products faster with configurable rules, pre-built templates, and an extensive integration network

- Reduce infrastructure spend with SaaS deployment and automated updates

- Grow without limits. Bring in new technologies with ease and keep innovation moving without being held back by legacy systems

How Guidewire Insurance Software Helps Insurers Perform at Their Best

Built with capabilities that strengthen performance at every level, from operations and analytics to innovation and growth

- Handle growing demand confidently with performance and reliability that scale as your business does

- Change products and workflows quickly without long development cycles or IT bottlenecks

- Connect easily to the systems and partners you rely on through a broad marketplace of ready-to-use integrations

- Make informed decisions in underwriting, claims, and billing with built-in, real-time insights

- Add new capabilities or upgrade existing ones without re-platforming or disruption

- Meet SOC 2, ISO 27001, GDPR, and other regulatory standards

- Get up and running faster with ready-to-use templates and workflows designed for insurance

- Use explainable AI to strengthen decisions across underwriting, claims, and customer interactions. Improve accuracy and efficiency while opening new paths for growth

Choosing Your Guidewire Core Platform

Why Guidewire’s Data-Driven Insurance Platform? Differentiators-at-a-Glance

1

Modern, Flexible Architecture

- Modular design that scales with growth and market change

- Upgrades applied without service disruption

- Security and compliance aligned with globally recognized standards

2

Configurable Product and Process Design

- Tools to adapt products, rating, workflows, and rules with speed

- Fast rollout of updates across multiple lines of business

3

Extensive Integration Ecosystem

- Hundreds of pre-built connections in the Guidewire Marketplace

- KPIs for real-time data exchange with distribution, partners, and data providers

4

Embedded Analytics and Intelligence

- HazardHub, Predict, and Data Studio embedded directly into workflows

- Delivers real-time risk scoring, intelligent underwriting, and automation in claims handling