If you’ve spent any time in insurance technology, you know the industry’s core systems have undergone a dramatic transformation over the years. At Guidewire, our journey from monolithic beginnings to today’s modular, AI-ready Application Services mirrors the insurance sector’s relentless push for agility, resilience, and innovation.

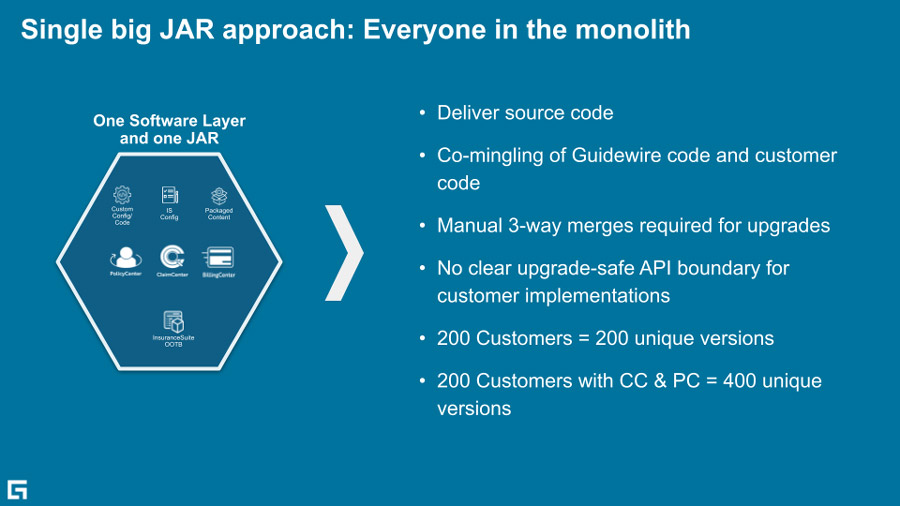

I. The Monolith Era: Stability and Depth for a Complex Industry

In the early 2000s, insurers needed deeply integrated, reliable systems to manage the intricate processes of policy, billing, and claims. Guidewire’s monolithic InsuranceSuite delivered a unified platform with rich functionality and a consistent user experience. For an industry built on trust and regulatory rigor, this approach provided the stability and compliance insurers demanded. However, as digital expectations grew and product cycles accelerated, the monolith delivered as a single, large JAR file presented challenges in terms of upgrade speed, costs of customization, and ability to scale.

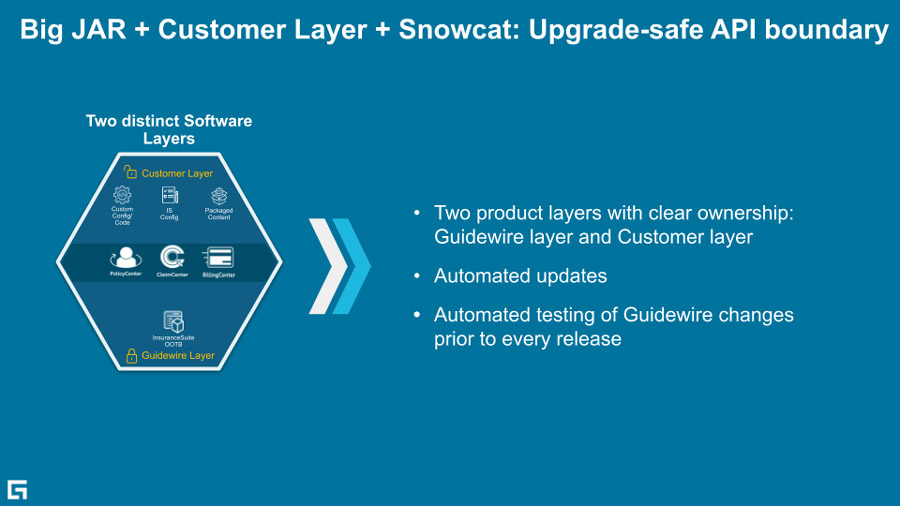

II. A. Cloud Updates: Breaking the Monolith, Enabling Agility

The rise of cloud computing was a major turning point. Guidewire’s move to the Guidewire Cloud Platform (GWCP) was about more than just hosting—it was about delivering continuous, automated updates, elastic infrastructure, and managed services. A pivotal architectural shift in this era was the breaking up of the monolith into two distinct layers: the Guidewire layer (core, upgradeable code managed by Guidewire) and the customer layer (customizations and extensions unique to each insurer). This separation allowed Guidewire to deliver regular, non-disruptive updates to the core platform, while customers could safely maintain their own extensions. For the industry, this meant staying current with the latest features and security patches, reducing IT overhead, and accelerating speed-to-market.

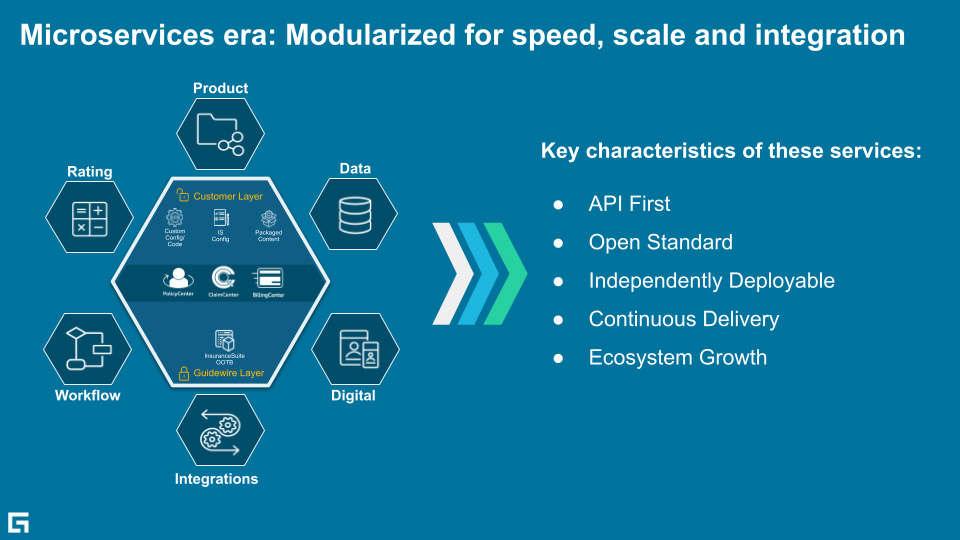

II. B. Microservices: Modularizing for Speed, Scale, and Integration

While the Cloud Updates era was transforming how insurers consumed and maintained their core systems, the Microservices era was running in parallel, redefining how those systems were architected and extended. As digital ecosystems expanded, insurers needed to innovate faster and integrate with a growing array of third-party services. Guidewire responded by decomposing core capabilities into microservices: independently deployable components that could be developed, scaled, and updated in parallel.

This new era was ushered in by the launch of Advanced Product Designer (APD) and Integration Gateway, which laid a strong foundation for product design and integration across the Guidewire ecosystem. Building on that momentum, the introduction of Data and Digital Platforms, along with Workflow and Rating, enabled insurers to confidently explore digital channels, reduce upgrade risks, and unlock a new level of versatility with microservices-architected Application Services. For the industry, microservices meant the freedom to adapt to changing customer needs and regulatory requirements without overhauling entire systems.

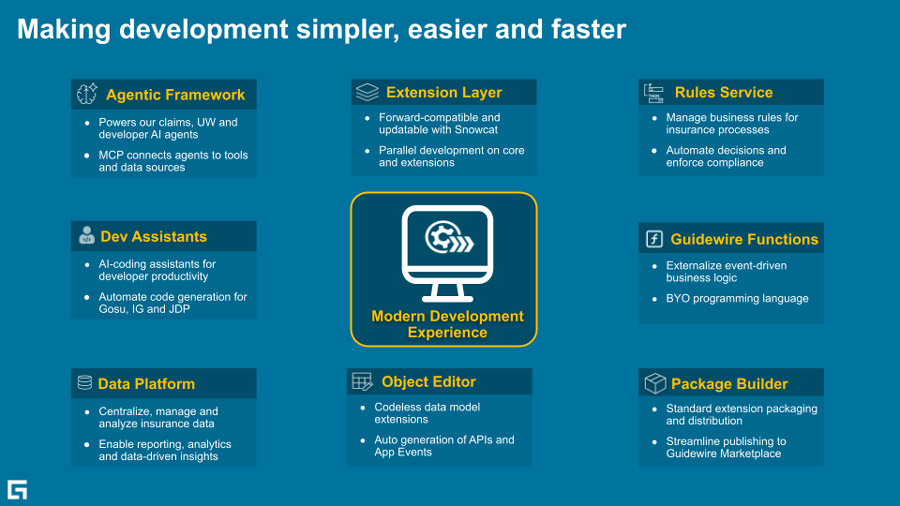

III. Hybrid Tenancy: Reimagining Developer Experience

The hybrid tenancy model, combining “Left-Hand Side” (LHS) multi-tenant, cloud-native microservices with “Right-Hand Side” (RHS) single-tenant InsuranceSuite cores, has been a powerful foundation in Guidewire's cloud architecture, offering security, flexibility, and scalability. Building on this great foundation, Guidewire’s modernized development experience streamlines and accelerates development through a powerful combination of cloud-native tooling, visual and declarative configuration, modular and update-safe extension architecture, open standards, and GenAI-powered productivity.

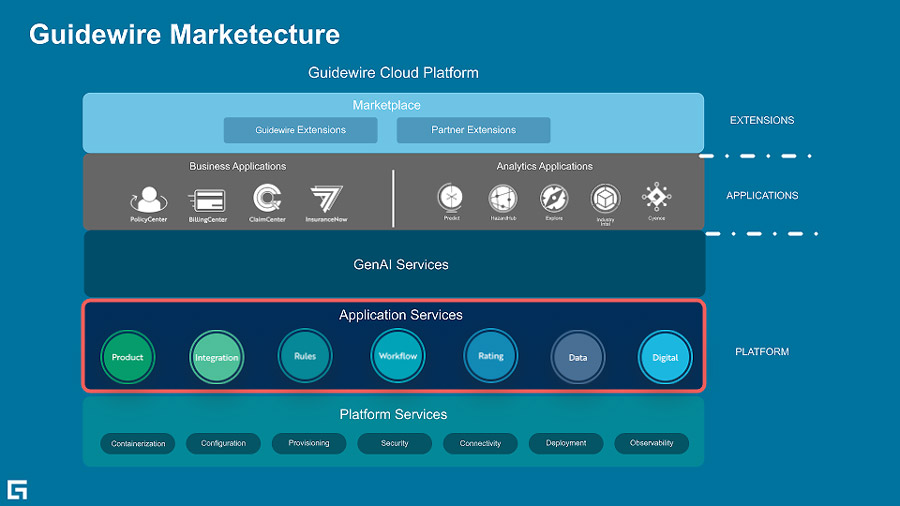

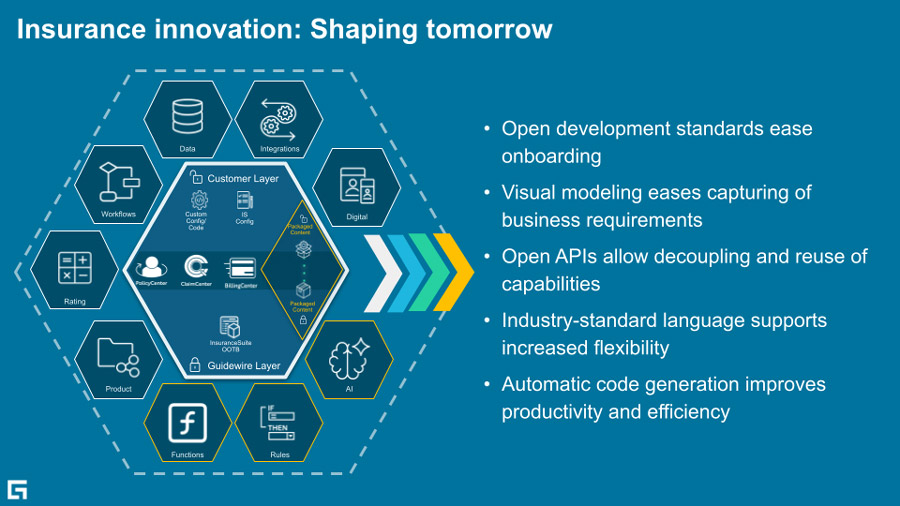

IV. The Future of Insurance Innovation

Today’s Application Services, seamlessly integrated within the Guidewire Cloud Platform (GWCP), epitomize the successful culmination of this evolutionary journey. They furnish a fully modular, cloud-native foundation for building, packaging, and deploying managed, upgrade-safe applications and extensions by Guidewire, partners, or customers. In an industry facing relentless disruption, these services enable continuous innovation, seamless integration, and measurable business value. This journey goes beyond technology, as it is about equipping insurers to not just survive, but thrive and lead in a world defined by constant change.

As someone documenting this evolution from the inside, I can safely say: the best is yet to come.

Subscribe to our Developer Newsletter for early access to reports like these and more, received directly in your inbox.