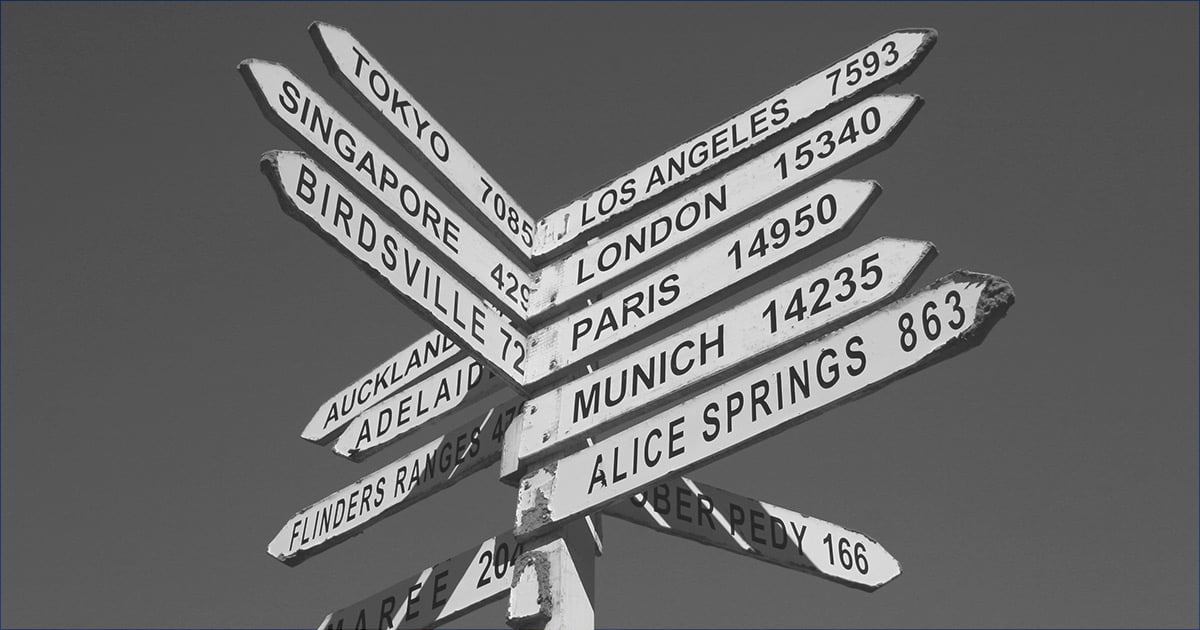

Whenever I describe Guidewire, I often refer to us as an “extreme vertical,” meaning that we focus on serving a single industry: property and casualty (P&C) insurance. We are also a global company, with more than 450 customers around the world and regional offices to serve them. I explain that our customers range from small farm bureaus to multi-nationals, and nearly all of them want to expand their market reach. Our goal at Guidewire is to help them do that.

That’s my standard pitch and I’m pleased to add even more proof points to support it because, with our Elysian release, we have expanded our Guidewire GO capabilities so our customers can grow by improving time to market, launching new products faster, and extending into new lines of business and territories.

For Elysian, we have added new product models to the dozens that are already available on Guidewire Marketplace:

USA AAIS Commercial Inland Marine

InsuranceNow GO Farmowners

Australia Workers’ Compensation

Global Affinity

Extended Warranty and Device Protection

These pre-built visual models help insurers in different regions to accelerate product development by leveraging the collective best practices of Guidewire and our partners. The new models are also global in scope — notice that we have built content for insurers around the world, from commercial lines insurers in North America to workers’ compensation insurers in Australia.

We have not forgotten personal lines insurers either. For example, we have extended personal motor capabilities for insurers that do business in Australia. To learn more, read my colleague James Couzens’s excellent blogpost, A Journey of a Thousand Miles.

Ten thousand miles from Australia, we have also expanded support for personal motor insurers in France. Guidewire GO makes it easier for French insurers to process claims efficiently with pre-built integrations for the IRSA and IRCA conventions, and streamlined bodily injury claims processing and subrogation. Our customers now benefit from automated allocation of claims to the right convention, real-time asynchronous messaging, and faster payment processing.

Across the Channel, we have also added capabilities to support London Market insurers. Global specialty and complex commercial insurers can now create tailored policy models with flexible business class and cover hierarchies; place business across open market direct, reinsurance, and delegated authority; and process and administer accounting and settlement messages across Lloyd’s and company markets. Additional new features have been added to help insurers reduce duplicate data entry, automate pre-bind underwriting checks, and proactively manage underwriting capacity.

So thanks to Elysian, my pitch has become even stronger. Guidewire has invested significantly in developing market-specific Guidewire GO content and, with each Cloud release, we will continue to expand our investments around the world.

To learn more, watch our Elysian release, visit Guidewire Marketplace, and register for Connections 2022 in Las Vegas where you will get the latest updates on Guidewire GO.