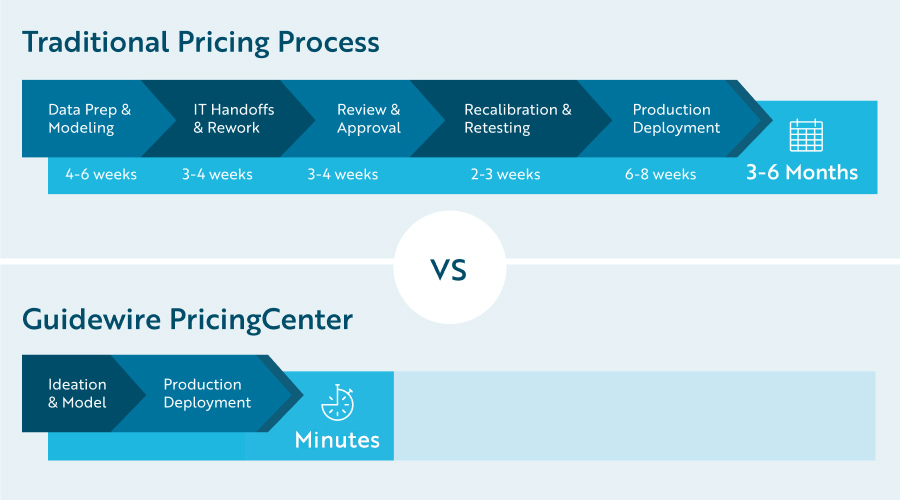

“'Time is money' is especially true when it comes to pricing decisions. PricingCenter is the tool our actuarial team needed to speed up the process from raw data to usable models to actionable pricing decisions. This process now takes days instead of months.”

Amanda Evenson

VP, Data and Analytics