Climate and Energy

We believe it is important for the health of both our business and our communities that we invest in measures that reduce the environmental impact of our physical operations – focusing on operational eco-efficiency and making strategic investments that enhance the resiliency of our company, reduce costs, and decrease our carbon footprint. Given the nature of our business, our environmental impacts stem primarily from our Scope 3 emissions (as defined below).

Our Goals Toward a More Sustainable, Low-Carbon Future

In fiscal year 2024, the Science Based Target initiative (“SBTi”) validated our near-term science-based targets (“SBTs”) in line with the long-term goal of the Paris Agreement to limit global warming to 1.5 degrees Celsius.1

Our Climate Targets2

We aim to create and maintain a sustainable, responsible business. To this end, the following near-term science-based emissions reduction target commitments were validated by SBTi:

- Reduce absolute Scope 1 and Scope 2 greenhouse gas (“GHG”) emissions by 50% by fiscal year 2030 compared to our fiscal year 2020 baseline year.

- Reduce absolute Scope 3 GHG emissions from fuel and energy related activities (“FERA”), business travel, and employee commuting by 42% within the same timeframe.

- Increase to 50% the portion of our suppliers by emissions covering purchased goods and services that have SBTs by fiscal year 2028.

In support of increased operational sustainability, we are also working toward sourcing renewable energy for 100% of the global power needs of our offices annually by fiscal year 2030.3

Our strategy to achieve — and maintain — our climate goals are informed by our SBTs and focused on the following pillars:

- Evolving our Supplier Sustainability program: We aim to engage our suppliers in setting SBTs and taking other steps to reduce their environmental impacts. Based on our most recent data, 39.2% of our suppliers by emissions have either committed to or set SBTs.

- Improving efficiency: We have undertaken a range of energy efficiency measures across our operations and plan to implement additional measures in the coming years. Six of our office buildings hold a green building or green business certification through the landlord, which represents 60.5% of total active square footage. We expect both numbers to continue to increase.

- Sourcing renewables: We are focused on increasing renewable energy procurement in select Guidewire offices through local utility renewable energy programs and the purchase of renewable energy certificates (“RECs”) to satisfy our 100% renewable energy target where renewable energy options may be limited due to our leasing arrangements. In our most recent reporting period, 45.9% of our energy came from renewable sources - a decrease of 5.1% over the prior period. This is due to higher energy usage in offices where we do not have a renewable energy option.

- Advancing the work of our internal Sustainability Working Group: As a complement to the Sustainability Task Force, this working group is advising on our Climate Risk Assessment and may advise on the creation of sustainable business travel guidance in the future.

Our Operational GHG Footprint(a)

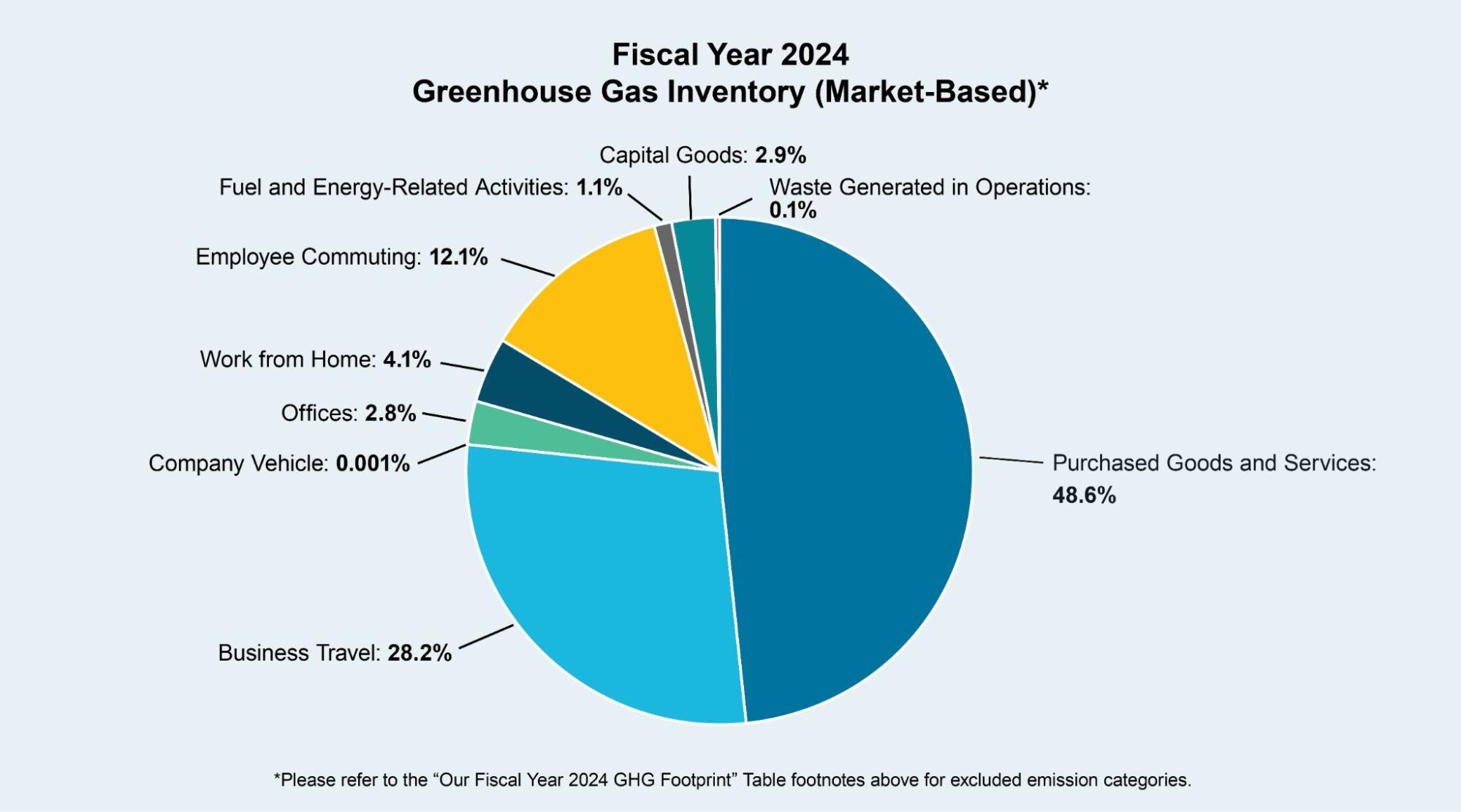

Guidewire’s operational GHG footprint stems from powering our buildings (e.g., electricity, heating, and cooling)4, business travel, and purchased goods and services. Our total absolute Scope 1 and 2 emissions have decreased by 42.8% since our fiscal year 2020 baseline due to greening of the electrical grid and strategic rightsizing of our real estate portfolio, leading to a decrease in office square footage occupied. The largest drivers of our overall GHG footprint are Scope 3 purchased goods and services and business travel. Our absolute Scope 3 GHG emissions from fuel and energy related activities (“FERA”)5, business travel, and employee commuting decreased 9.3% in fiscal year 2024 compared to our fiscal year 2020 baseline, with FERA falling by 8%; employee commuting rising by 138.4%, and business travel falling by 28.7%6.

| Scope 1 | Scope 2(b) | Scope 3(c) | |

| Fiscal Year 2024 Emissions | 26 |

Location-Based – 1,246.5 Market-Based – 810.9 |

Market-Based — 29,397 |

| Type | Direct emissions from owned or controlled sources | Indirect emissions from the generation of purchased energy and estimated refrigerants | Other indirect emissions sources |

| Emissions Sources | Fuel to heat buildings, diesel to run generators | Purchased energy for leased facilities for which Guidewire controls the energy usage and pays the utility bills, estimated refrigerants | Business travel, including air, rail, reimbursed personal vehicle, and rental car; purchased goods and services and capital goods; waste and FERA from our leased offices; employee commuting; and work from home |

| % of Fiscal Year 2024 Emissions(d) |

0.1% MtCO2e |

2.7% MtCO2e |

97.2% MtCO2e |

| Emissions Reduction Strategies(e) |

Reduce energy consumption Rightsize real estate portfolio |

Reduce energy consumption Work with landlords to purchase and execute renewable energy procurement agreements Purchase RECs Rightsize real estate portfolio |

Train buyers on sustainable procurement practices Utilize technology, such as our travel booking platform’s sustainability features, to guide environmentally sustainable business travel choices Reduce business travel Offset business travel emissions through sustainable aviation fuel |

Looking Forward

After a normalization of emissions post-COVID, we expect a continued increase in Scopes 1, 2 and 3 emissions going forward as we continue to grow our customer base and revenue, and expand business operations and business travel. In the near-term, we aim to reduce our emissions relative to business growth, where possible, by more fully implementing our strategy to achieve our climate goals: increasing renewable energy procurement, increasing energy efficiency, evaluating potential company-wide sustainable travel guidance in conjunction with our Sustainability Working Group, and engaging with our suppliers on their environmental impacts. Absolute reductions are likely to require innovations in sustainable travel, such as sustainable aviation fuel, access to emerging renewable energy options and electrification, and greater efficiencies in computing and data management.