Industry Trends

The Future of Auto Claims – Part One: Liability, Data, and the Changing Role of InsurersGuidewire Blog

Featured

Niseko is Here. The Latest Guidewire Release Powers Smarter Analytics, Insights, and Automation across the P&C Lifecycle

Technology

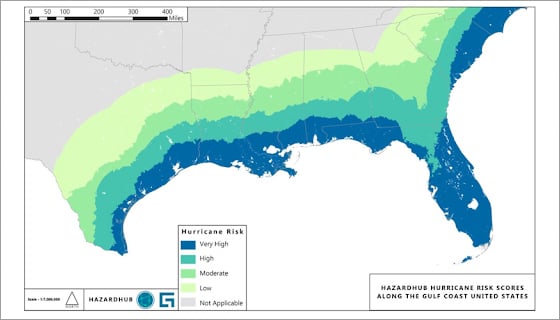

Millions of U.S. Homes at Risk During Hurricane Season

General Interest

Navigating Insurtech's Future: A Chat with Guidewire's Carol-Ann Gough

Industry Trends

Navigating the Storm: Insurance Carriers Amid Nuclear Verdicts

Technology

Industry Trends

Best Practices

General Interest

Partner Perspective

Developer

Careers

Subscribe to Our Blog!

Receive a notification when new blogs are posted and keep track of the latest Guidewire information.