„We’re able to process more quotes and binds simply by calling the API that HazardHub provides, which eliminates a lot of the human interaction factors required to obtain information about an insured or property.”

Luis Velazques

SVP of Technology

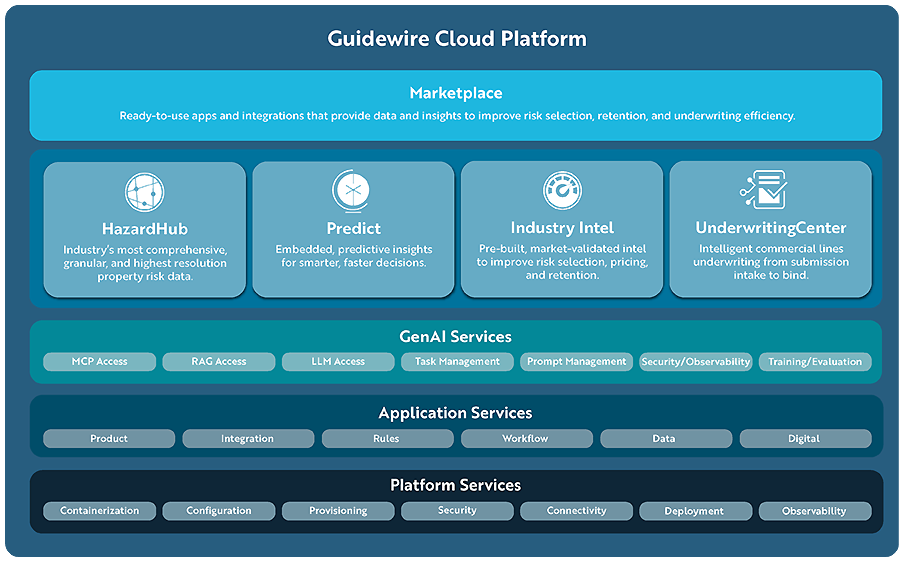

Underwriting performance is tied to a range of factors, such as how well insurers can use their data, manage repair costs, and align risk decisions with appetite and margin goals. Guidewire helps insurers summarize complex submissions, integrate real-time risk signals, automate repeatable decisions, and enable underwriters to focus on improving portfolio performance.

80%of data received is unstructured |

70%of time spent is on non-critical tasks |

Source: Quantiphi

Source: Accenture and the Institutes

Select profitable risks, enhance the broker experience, and maximize customer lifetime value.

Guidewire empowers underwriters to be more productive and make smarter, faster decisions, resulting in reduced loss ratio, better retention rates, and higher profitability.